In today's globalized economy, currency exchange rate fluctuations significantly impact daily life and financial decisions. The conversion between Swaziland's Lilangeni (SZL) and the US Dollar (USD) presents an interesting case study of how emerging market currencies interact with global financial systems.

The Current Exchange Rate

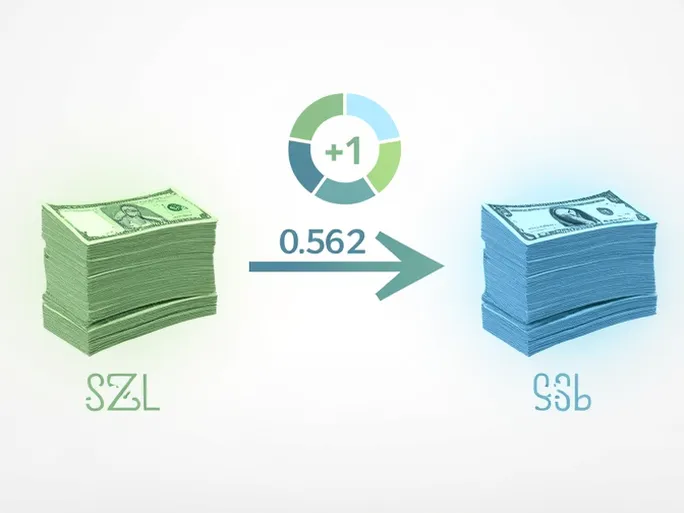

As of the latest data, the exchange rate stands at 1 SZL = 0.0562 USD . This means that converting 100 Lilangeni would yield approximately $5.62 . The inverse relationship shows that 1 USD currently buys about 17.79 SZL , reflecting the dollar's continued strength in international markets.

Economic Implications

The exchange rate between these currencies reveals important insights about Swaziland's economic position. Over the past year, the Lilangeni has shown modest appreciation against the dollar, with the exchange rate improving by approximately 2.98% . This stability suggests gradual economic strengthening and potential investment opportunities.

Historical data indicates that the exchange rate has remained relatively consistent, with records from August 11, 2023 showing the same 0.0562 USD conversion value for 1 SZL. Such stability is noteworthy in Africa's often volatile currency markets.

Practical Applications

Understanding currency conversion goes beyond simple arithmetic. For travelers, investors, and international traders, exchange rate knowledge can mean the difference between profit and loss. When planning transactions involving these currencies, several factors should be considered:

1. Timing : Exchange rates fluctuate constantly based on global market conditions

2. Transaction costs : Banks and exchange services often charge fees that affect the final amount

3. Economic indicators : Inflation rates, interest rates, and political stability all influence currency values

Strategic Considerations

For those regularly dealing with SZL-USD conversions, monitoring exchange rate trends is essential for developing effective hedging strategies. The relative stability of the Lilangeni suggests it may serve as a potential hedge against more volatile African currencies, while its connection to the South African Rand (through the Common Monetary Area) provides additional economic context.

In international trade, currency fluctuations can dramatically affect pricing structures and profit margins. Businesses engaged in cross-border commerce between Swaziland and dollar-denominated markets must account for these variables in their financial planning.

As global economic conditions continue to evolve, maintaining awareness of currency movements remains crucial for making informed financial decisions in both personal and professional contexts.