In today's rapidly changing global economy, currency values and exchange rate fluctuations have become crucial factors for investors and traders worldwide. The exchange rate between the Comorian Franc (KMF) and the US Dollar (USD) serves as a vital indicator guiding economic interactions between these two currencies.

Current Exchange Rate Overview

As of August 11, 2025, the exchange rate stands at approximately 0.00236611 USD per 1 KMF , meaning 1 USD equals about 422.634 KMF . This data reveals the Comorian currency's position in the international economy and provides valuable reference points for potential investors considering capital deployment in Comoros.

The island nation of Comoros, though geographically small, possesses unique economic advantages in the Indian Ocean region. Its strategic location and specialized exports create distinct dynamics in its currency valuation.

Recent Exchange Rate Volatility

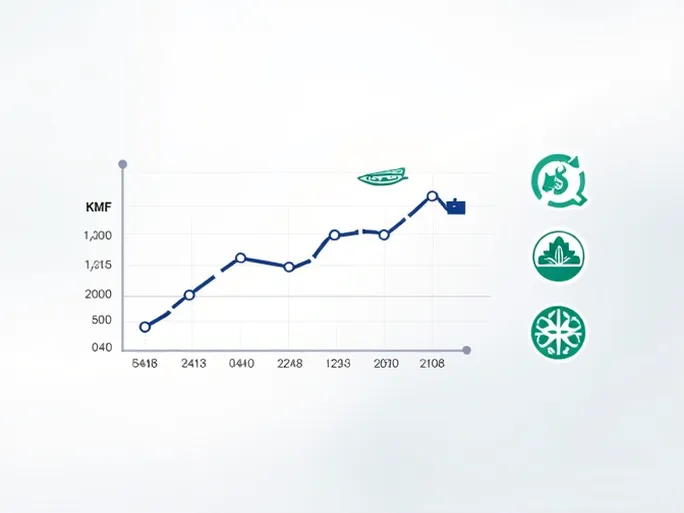

Over the past 30 days, the KMF/USD exchange rate has experienced noticeable fluctuations, ranging from a low of 0.0023536 USD to a high of 0.0023735 USD . These movements reflect complex economic undercurrents and market responses to both domestic and international developments.

Exchange rates are influenced by multiple factors including national economic conditions, international market environments, supply-demand dynamics, and political stability. For smaller economies like Comoros, even minor changes can trigger significant currency fluctuations.

Longer-Term Trends and Analysis

Examining the 90-day historical data reveals more pronounced volatility, with the exchange rate reaching a peak of 0.0023997 USD and bottoming at 0.0022554 USD . These wider fluctuations present both challenges and opportunities for investors seeking optimal entry points.

The recent exchange rate movements correlate with several macroeconomic factors: shifting global economic conditions, evolving market demand patterns, international geopolitical tensions, and domestic economic policies in Comoros. For instance, increased international demand for Comoros' spice and agricultural exports could strengthen the KMF, while global economic downturns might lead to depreciation.

Investment Considerations

For investors navigating this volatility, continuous monitoring of KMF/USD exchange rate developments remains essential. Financial analysts typically recommend combining fundamental economic analysis with technical examination of currency support and resistance levels to inform decision-making.

Comoros' unique economic characteristics and ongoing reforms present both opportunities and challenges. The government has implemented various economic policies aimed at attracting foreign investment and enhancing international competitiveness. However, the effects of such reforms often materialize gradually, requiring investors to maintain a balanced perspective between short-term fluctuations and long-term potential.

Technological Advancements in Currency Tracking

The digital revolution has transformed currency monitoring, with online foreign exchange platforms now providing real-time KMF/USD rate updates. This accessibility enables more sophisticated investment strategies, particularly for businesses engaged in international trade who need to manage currency risk and optimize transaction costs.

Understanding the KMF/USD exchange rate trends serves multiple purposes: it aids investment decision-making, facilitates international trade planning, and offers insights into global economic dynamics. For participants in global economic activities, comprehensive analysis of exchange rate movements and their underlying causes remains an indispensable component of financial strategy.