In the complex world of international money transfers, understanding the correct tools and protocols is essential—especially when dealing with cross-border financial transactions. Today, we examine a critical element that anyone sending funds to Argentina must understand: the SWIFT/BIC code. This globally recognized banking identifier not only simplifies international transfers but also provides security for each transaction.

What Is a SWIFT/BIC Code?

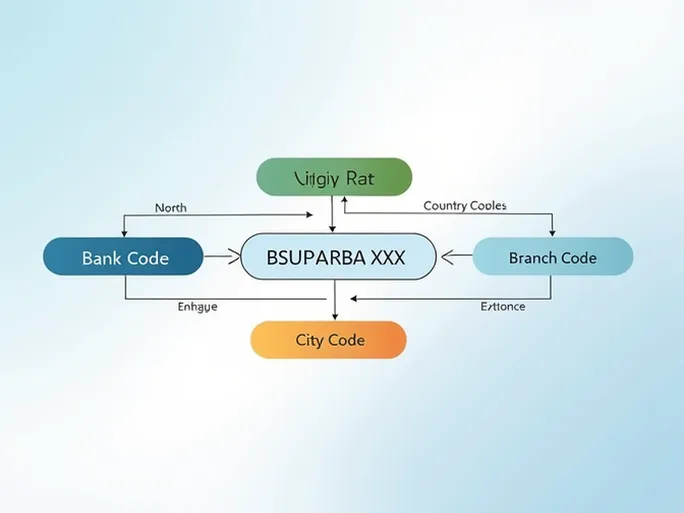

SWIFT—the Society for Worldwide Interbank Financial Telecommunication—is a messaging network used by financial institutions worldwide to securely and efficiently process international transactions. A SWIFT code, also known as a Bank Identifier Code (BIC), uniquely identifies each participating bank. These codes consist of 8 to 11 carefully structured characters that specify the bank, country, and location.

For Argentina's Banco Supervielle, the SWIFT code is BSUPARBAXXX . This combination of letters and numbers serves as the foundation for successful international transfers to this institution.

Decoding the SWIFT/BIC Structure

Let's examine the components of BSUPARBAXXX :

- BSUP : Identifies Banco Supervielle

- AR : The country code for Argentina

- BA : Represents Buenos Aires, the bank's headquarters location

- XXX : Optional branch identifier (XXX typically denotes the primary office)

Why BSUPARBAXXX Matters

Using the correct SWIFT code is the first step in ensuring your funds reach Banco Supervielle securely. International transfers require precise information to avoid delays or misdirected payments.

Follow these steps for successful transfers:

- Verify transfer details : Confirm the amount, purpose, and recipient's complete banking information.

- Enter the correct SWIFT code : Input BSUPARBAXXX accurately in your transfer request.

- Select a reliable service provider : Choose a bank or transfer service with international capabilities.

- Understand fees and timing : Compare processing times and costs among different providers.

The Critical Role of SWIFT Codes

Without standardized identifiers like SWIFT codes, international banking would be significantly more complicated. These codes enable financial institutions to quickly and accurately process cross-border payments. Every successful international transfer relies on this system of verification.

Delays often occur when incorrect or incomplete SWIFT information is provided. Ensuring accuracy prevents funds from being held in limbo during processing.

Key Considerations Before Transferring

Before initiating your transfer using BSUPARBAXXX , verify these details:

- The recipient's account information matches the bank records exactly

- The country code matches the destination nation

- You understand the complete transfer process, including fees and expected completion time

After Your Transfer

Most financial institutions provide tracking options for international transfers. Monitor your transaction's progress through your bank's online portal or customer service channels. Stay informed until the recipient confirms the funds have arrived.

Conclusion

International money transfers have become essential in our globalized economy, and SWIFT/BIC codes provide the security and efficiency these transactions demand. Understanding Banco Supervielle's SWIFT code ( BSUPARBAXXX ) equips you with knowledge for successful future transfers to Argentina.

Whether you're a business professional conducting international commerce or an individual sending funds to family abroad, mastering these financial fundamentals makes cross-border transactions smoother and more reliable. With this knowledge, you're prepared to navigate international banking with confidence.