In today's globalized economy, international money transfers have become an essential part of personal and business transactions across borders. However, ensuring that these transfers are fast, secure, and accurate remains a top concern for all parties involved. One critical element in this process is understanding and correctly using SWIFT/BIC codes. These standardized bank identification codes play a vital role in ensuring funds reach their intended destination without financial risks.

Using Banco de la Nación Argentina's SWIFT code, NACNARBACOR , as an example, this article provides a comprehensive breakdown of how SWIFT codes function, helping individuals and businesses conducting transactions with Argentina—or any other country—navigate international transfers with confidence.

What Is a SWIFT Code?

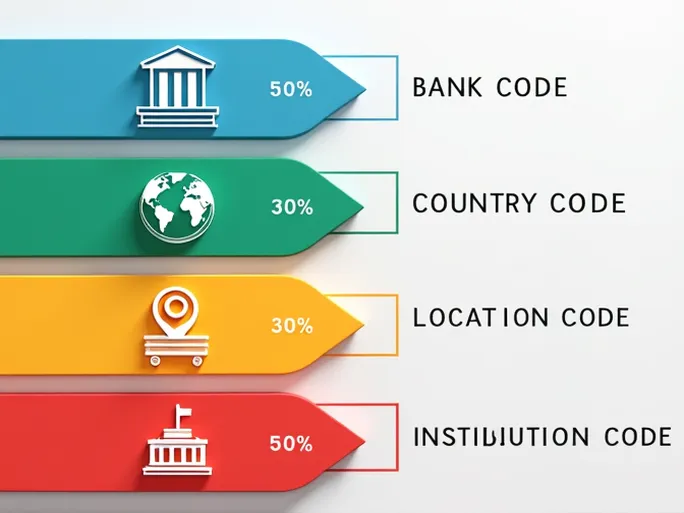

SWIFT (Society for Worldwide Interbank Financial Telecommunication) is a cooperative organization formed by major global banks to provide secure and efficient international communication and transfer services for financial institutions. The SWIFT code, also known as the BIC (Bank Identifier Code), is a standardized format used within this network. Typically consisting of 8 to 11 characters, the code is divided into four distinct parts: the bank code, country code, location code, and branch code. These components ensure that funds are transferred quickly and securely between institutions worldwide.

Breaking Down a SWIFT Code

To understand how a SWIFT code functions in international transactions, let’s examine Banco de la Nación Argentina's code, NACNARBACOR , in detail:

- Bank Code (NACN): The first four characters identify the financial institution—in this case, Banco de la Nación Argentina. Using the correct bank code is crucial to avoid misdirected funds, which could result in financial losses.

- Country Code (AR): The next two characters represent the country where the bank is registered, following the ISO country code standard (AR for Argentina). Understanding the destination country helps senders assess regulatory requirements and transfer conditions.

- Location Code (BA): These two letters indicate the bank’s city or region. Accurate location details ensure funds are routed efficiently within the country, preventing unnecessary delays or additional fees.

- Branch Code (COR): The final three characters specify the exact branch of the bank. This precision minimizes errors and ensures funds reach the intended recipient without unnecessary detours.

By understanding these components, users can enhance the accuracy of their international transfers, reduce costs, and increase transaction speed. For individuals unfamiliar with SWIFT codes, taking the time to learn their structure can alleviate concerns about cross-border payments.

Practical Applications of SWIFT Codes

SWIFT codes are indispensable in international money transfers. For example, if an individual wishes to send money to a friend in Argentina, they must first obtain the recipient’s bank SWIFT code. Ensuring the code is up-to-date is critical, as banks may occasionally update their SWIFT information. Once the sender inputs the correct code (e.g., NACNARBACOR ), the transfer process begins.

Additional steps, such as completing transfer forms and providing identification, may be required. The banking system then uses the SWIFT network to route the funds securely to the recipient’s account at Banco de la Nación Argentina.

Key Considerations for International Transfers

To ensure smooth and secure transactions, users should keep the following in mind:

- Verify SWIFT Code Accuracy: Always double-check the SWIFT code before initiating a transfer, as errors can lead to misdirected funds.

- Understand Transfer Fees: International transfers often incur fees, which vary by bank and transaction size. Review these costs beforehand to avoid surprises.

- Account for Processing Times: Transfer durations may be affected by banking hours, holidays, or intermediary banks. Plan accordingly to avoid delays.

- Comply with Regulations: Different countries have varying foreign exchange policies. Familiarize yourself with the destination country’s laws to ensure compliance.

Conclusion

SWIFT/BIC codes are fundamental to international money transfers, ensuring efficiency and security in cross-border transactions. By analyzing Banco de la Nación Argentina’s SWIFT code, NACNARBACOR , this article has illustrated how these codes function and their importance in global finance. Whether for personal remittances or business transactions, maintaining accuracy and awareness of SWIFT codes is essential for seamless, secure, and cost-effective money transfers.