Have you ever experienced the frustration of delayed or failed international money transfers? Many have faced the awkward situation where all procedures appeared complete, yet a minor oversight caused funds to be delayed or even lost in transit. In the complex world of international banking, precision matters—especially when it comes to SWIFT codes. Today we examine the SWIFT code UNAFNGLA009 for United Bank for Africa Plc and reveal best practices for seamless cross-border transactions.

Understanding SWIFT Codes

The SWIFT (Society for Worldwide Interbank Financial Telecommunication) code serves as a standardized identifier for financial institutions globally. This 8-11 character alphanumeric sequence precisely identifies banks and their locations, functioning as essential coordinates for international transactions.

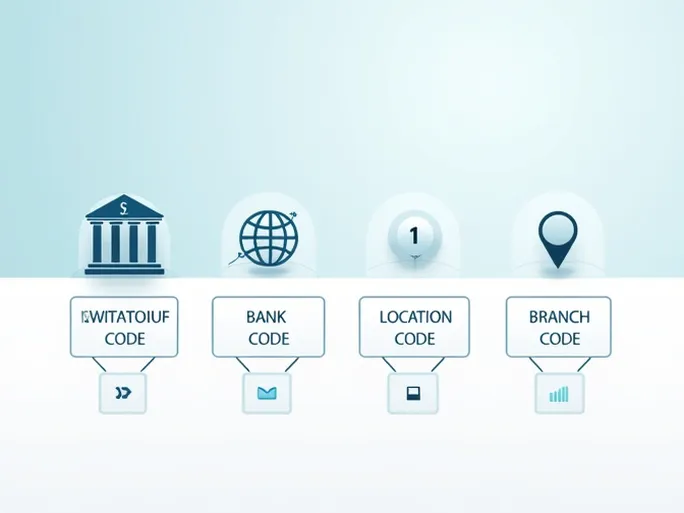

A SWIFT code's structure contains distinct components:

- Bank code (4 letters): Identifies the specific institution (e.g., UNAF for United Bank for Africa)

- Country code (2 letters): Specifies the nation (NG for Nigeria)

- Location code (2 characters): Pinpoints the bank's geographic position (LA)

- Branch code (3 optional characters): Identifies specific branches (009)

These codes act as a universal financial language, ensuring accurate information routing and preventing transfer delays caused by identification errors.

The Strategic Importance of SWIFT Codes

While account numbers and bank names seem sufficient for domestic transfers, SWIFT codes serve three critical functions in international finance:

- Precision in global communications: As standardized identifiers, they eliminate ambiguity in interbank messaging systems.

- Operational efficiency: Automated processing reduces manual verification requirements, accelerating transaction speeds.

- Risk mitigation: Correct codes prevent misrouted funds, ensuring intended recipients receive transfers.

Practical Guide: Using UNAFNGLA009

Verification Protocol

When initiating transfers to United Bank for Africa, adhere to these verification steps:

1. Institutional name matching: Confirm the recipient bank's exact legal name appears as "United Bank for Africa" without abbreviations.

2. Branch specification: The suffix "009" indicates a particular branch. When uncertain, consult the bank's official branch directory or contact the recipient for confirmation.

3. Country validation: The "NG" component confirms Nigeria as the destination country. Cross-check this against the recipient's provided information.

Transfer Procedure

Modern digital platforms have streamlined international transfers into five key steps:

- Account registration with required personal/business details

- Input of transfer parameters (amount, recipient details including UNAFNGLA009)

- Review of real-time exchange rates and applicable fees

- Final verification and transaction submission

- Status monitoring through digital tracking tools

Essential Considerations for SWIFT Transfers

Prudent senders should account for these operational factors:

- Standard processing times (typically 1-3 business days)

- Potential intermediary bank fees

- Cut-off times for same-day processing

- Recipient country banking holidays

Security protocols remain paramount—always verify recipient authenticity through multiple channels before initiating transfers.

Conclusion

In global finance's intricate web, the humble SWIFT code serves as both compass and passport for funds crossing borders. The UNAFNGLA009 identifier exemplifies how this standardized system enables secure, efficient transactions between Nigeria and the world. By mastering these financial coordinates, individuals and businesses can navigate international transfers with confidence and precision.