In today's globalized financial landscape, accurate bank identification methods are crucial. SWIFT/BIC codes serve as an internationally recognized standard that enables efficient cross-border transactions. This article examines the structure and significance of these codes, using Portugal's CAIXA GERAL DE DEPOSITOS as a case study.

Understanding SWIFT/BIC Code Structure

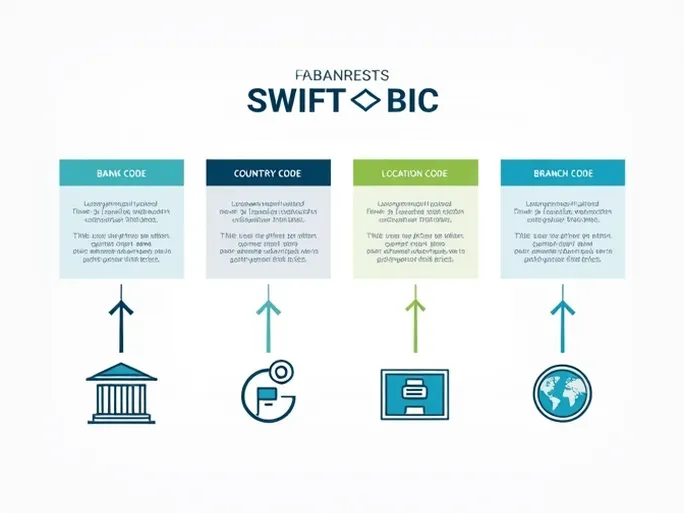

SWIFT/BIC codes typically consist of 8 to 11 characters that precisely identify financial institutions worldwide. The code CGDI PT PL MRS for CAIXA GERAL DE DEPOSITOS demonstrates this standardized format:

- Bank Code (CGDI): The first four letters uniquely identify CAIXA GERAL DE DEPOSITOS.

- Country Code (PT): The two-letter ISO country code designates Portugal.

- Location Code (PL): These characters specify the bank's geographic area.

- Branch Code (MRS): The final three characters indicate specific branches, with "XXX" representing the head office.

The Critical Importance of Accuracy

Precise SWIFT/BIC code usage is paramount for successful international transfers. Errors in these identifiers can lead to transaction failures, processing delays, and potential financial complications. When initiating cross-border payments, verification of the recipient bank's complete details—including name, branch information, and country—is essential for ensuring smooth transactions.

Optimizing International Transactions

Modern financial platforms have streamlined the international transfer process by offering competitive exchange rates, reduced fees, and expedited processing times. These services typically provide continuous customer support to address any SWIFT-related issues that may arise during transactions.

For individuals and businesses conducting international transfers, proper understanding of SWIFT codes combined with reliable financial platforms significantly enhances transaction security and efficiency. Preparing all necessary banking information in advance helps prevent complications and ensures funds reach their intended destination accurately and securely.