When conducting international wire transfers, one of the critical factors ensuring both security and timely delivery of funds is the correct use of SWIFT/BIC codes. These alphanumeric identifiers, comprising 8 to 11 characters, are designed to uniquely recognize banks and their branches worldwide, facilitating accurate transmission of transactional data across borders. SWIFT (Society for Worldwide Interbank Financial Telecommunication) serves as the standardized messaging network for global financial transactions, while BIC (Bank Identifier Code) plays a complementary role in streamlining cross-border payments. This article examines the structure of PT BANK DBS INDONESIA's SWIFT/BIC code, essential remittance details, and the advantages of using specialized services for international transfers.

Decoding the SWIFT/BIC Structure

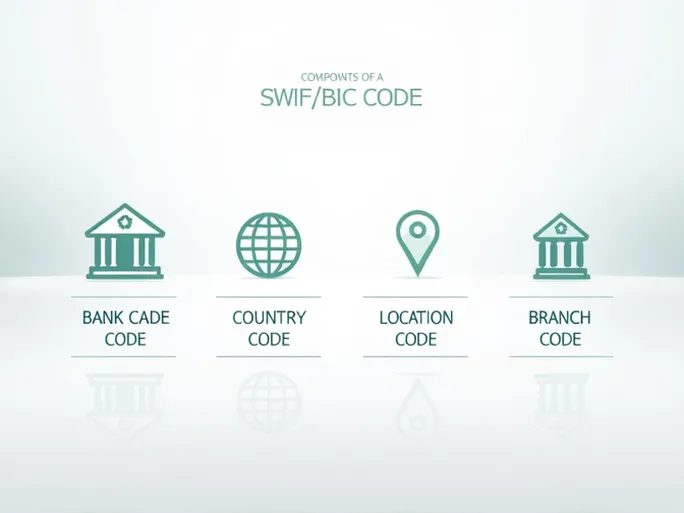

The SWIFT/BIC code of PT BANK DBS INDONESIA follows a systematic format that ensures precise routing of funds. Each segment of the code carries specific geographic and institutional information:

- Bank Code (4 characters): The initial four letters ( DBSB ) uniquely identify PT BANK DBS INDONESIA within the global banking network.

- Country Code (2 characters): The subsequent two letters ( ID ) denote Indonesia, confirming the destination country for the transfer.

- Location Code (2 characters): The following pair ( JA ) pinpoints the bank's headquarters or primary operational base.

- Branch Code (3 characters, optional): The final three characters (e.g., SBY ) specify a particular branch. An XXX suffix indicates the bank's head office rather than a subsidiary.

Thus, PT BANK DBS INDONESIA's complete SWIFT/BIC code may appear as DBSBIDJASBY (including branch details) or DBSBIDJA (8-character version for the primary office).

Essential Remittance Details for PT BANK DBS INDONESIA

To prevent delays or misdirected funds, senders must verify the following details before initiating a transfer:

- Bank Name: PT BANK DBS INDONESIA

- Branch: SURABAYA

- Address: WISMA TIARA, SURABAYA

Pre-Transfer Verification Checklist

Meticulous validation of transactional data is paramount for seamless cross-border payments. Key considerations include:

- Confirming the exact match between the recipient bank's registered name and the details provided in the transfer instruction.

- Validating the branch-specific SWIFT code (if applicable) to ensure alignment with the beneficiary's account location.

- Cross-checking the country code within the SWIFT/BIC against the recipient's actual jurisdiction.

- Scrutinizing account numbers and beneficiary information to eliminate discrepancies that could trigger rejections or processing delays.

Optimizing International Transfers

Specialized currency exchange and transfer platforms offer distinct advantages over traditional banking channels for cross-border payments. These include:

- Competitive Exchange Rates: Superior foreign exchange pricing compared to conventional banks, reducing conversion costs.

- Fee Transparency: Clear disclosure of all applicable charges before transaction confirmation.

- Expedited Processing: Same-day fund transfers through optimized payment networks.

- Security Protocols: Advanced encryption and compliance measures safeguarding transactional integrity.

Accurate utilization of SWIFT/BIC codes remains fundamental to successful international wire transfers. By combining rigorous verification practices with efficient transfer mechanisms, individuals and businesses can navigate global payments with confidence.