In international financial transactions, the accuracy of SWIFT/BIC codes is paramount. But what exactly is a SWIFT/BIC code? Comprising 8 to 11 alphanumeric characters, this unique identifier is used to recognize specific banks and their branches worldwide. For example, the SWIFT/BIC code for CAIXA ECONOMICA MONTEPIO GERAL, CAIXA ECONOMICA BANCARIA, SA is MPIOPTPLXXX .

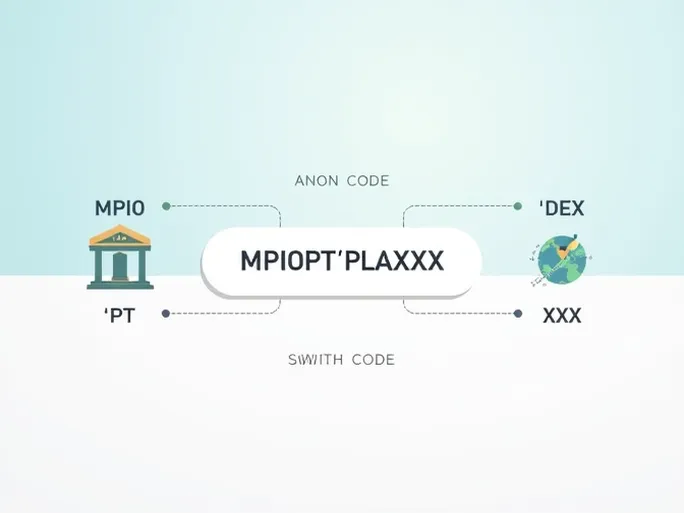

The structure of this code reveals key information:

- Bank Code (MPIO): The first four letters identify the specific bank—in this case, CAIXA ECONOMICA MONTEPIO GERAL, CAIXA ECONOMICA BANCARIA, SA .

- Country Code (PT): The next two letters indicate the bank's location in Portugal.

- Location Code (PL): These two characters specify the bank's local area.

- Branch Code (XXX): The last three letters, "XXX," denote the bank's headquarters.

Ensuring Accuracy in Cross-Border Transfers

When initiating international wire transfers, verifying the correct SWIFT code is essential to prevent delays or errors. Before proceeding, confirm the following:

- Bank Verification: Ensure the recipient bank's name matches the provided SWIFT code to avoid selecting the wrong institution.

- Branch Verification: If using a branch-specific SWIFT code, confirm it aligns with the recipient's bank branch.

- Country Verification: Given the global operations of many banks, double-check that the SWIFT code corresponds to the recipient bank's country.

In summary, SWIFT/BIC codes play an indispensable role in facilitating seamless global transactions. Their standardized format not only enhances the precision of financial operations but also reinforces security. Understanding these details empowers individuals and businesses to conduct international transactions with greater confidence.