In global interbank transactions, the SWIFT/BIC code serves as a critical identifier. This alphanumeric sequence not only verifies a bank's identity but also ensures the smooth and secure flow of funds across borders. Using Sweden's Skandinaviska Enskilda Banken AB (SEB) as a case study, we examine how these codes function.

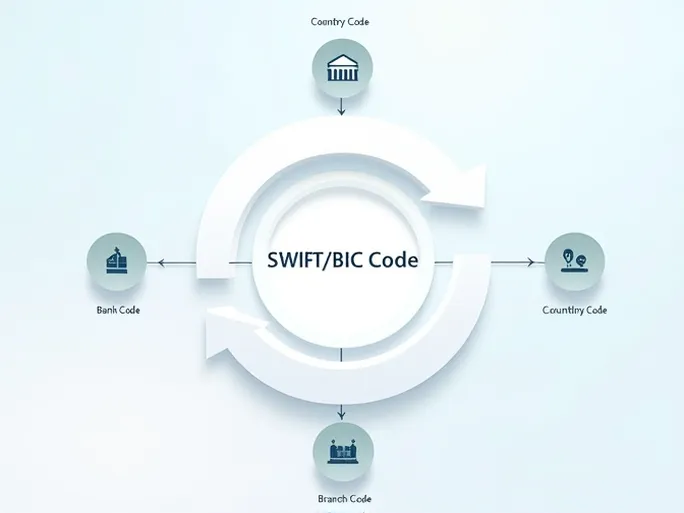

The Anatomy of a SWIFT/BIC Code

Comprising 8 to 11 characters, each SWIFT/BIC code follows a standardized structure that precisely identifies financial institutions worldwide. SEB's code— ESSESESSEQU —breaks down into four distinct components:

- Bank Code (ESSE) : Identifies Skandinaviska Enskilda Banken AB specifically.

- Country Code (SE) : The two-letter ISO designation for Sweden.

- Location Code (SS) : Pinpoints the bank's headquarters in Stockholm.

- Branch Code (EQU) : Specifies a particular branch, with "XXX" typically denoting the head office.

Complete SWIFT/BIC Breakdown for SEB:

Full Code: ESSESESSEQU

Bank Code: ESSE

Country Code: SE

Location Code: SS

Branch Code: EQU

Operational Significance

This precise encoding system enables financial institutions to process cross-border payments with remarkable accuracy. When initiating an international transfer to SEB's headquarters at Stjarntorget 4, Gamla Stan, Stockholm, the SWIFT/BIC code eliminates ambiguity, significantly reducing processing times and potential errors.

The system's design accommodates both broad identification (through country and bank codes) and granular specificity (via location and branch codes). This dual-layer verification has become indispensable in global finance, where a single character discrepancy can divert funds or delay transactions.

Security and Efficiency

Beyond facilitating transactions, SWIFT/BIC codes enhance financial security by creating an auditable trail. Each component provides verification checkpoints, helping institutions detect and prevent fraudulent activity. The codes' standardized format also simplifies compliance with international banking regulations.

For corporations and individuals conducting frequent international business, understanding a recipient bank's complete SWIFT/BIC details—as demonstrated with SEB—remains fundamental to ensuring seamless monetary transfers across the global financial network.