In modern international financial transactions, SWIFT/BIC codes play a pivotal role. These unique identifiers facilitate the swift and accurate transfer of funds between accounts while preventing delays caused by information discrepancies. For those conducting wire transfers through OTP BANKA D.D., understanding the bank's SWIFT/BIC code is essential for seamless transactions.

Selecting the Correct SWIFT Code

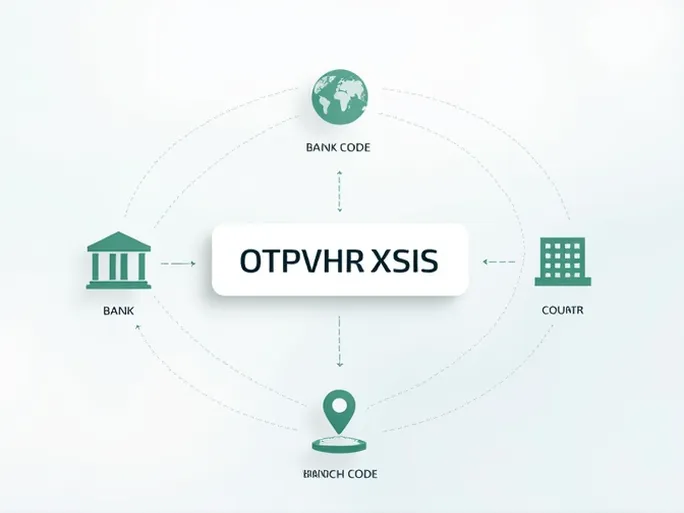

When initiating international transfers, how can one ensure funds reach the intended financial institution? The answer lies in using the appropriate SWIFT/BIC code. For OTP BANKA D.D., this code is OTPVHR2XSIS, with each segment serving a distinct purpose:

- Bank Code (OTPV): Identifies OTP BANKA D.D., confirming the correct financial institution.

- Country Code (HR): Denotes Croatia as the bank's location, verifying the destination country.

- Location Code (2X): Specifies the bank's headquarters, adding another layer of verification.

- Branch Code (SIS): When included, directs funds to a specific branch—in this case, the SISAK location.

Key Details for OTP BANKA D.D.

The primary SWIFT code OTPVHR2X, when combined with the branch identifier SIS, precisely routes transactions to OTP BANKA D.D.'s SISAK branch at Trg Ljudevita Posavskog 1. This information proves invaluable for both individual and corporate clients engaging in cross-border transactions, where precision is paramount.

Ensuring Seamless Transfers

During international transactions, accurate SWIFT codes are the first defense against processing delays and errors. Before initiating transfers, verify these critical elements:

- Bank Verification: Confirm the recipient bank's name matches the SWIFT code to prevent misdirected funds.

- Branch Specifics: When using branch-specific codes, double-check the location details to ensure proper delivery.

- Country Alignment: Verify that the SWIFT code corresponds to the recipient bank's country to facilitate smooth cross-border movement.

Every wire transfer carries responsibility. By confirming SWIFT code accuracy, senders don't merely complete transactions—they safeguard financial assets throughout the transfer process.