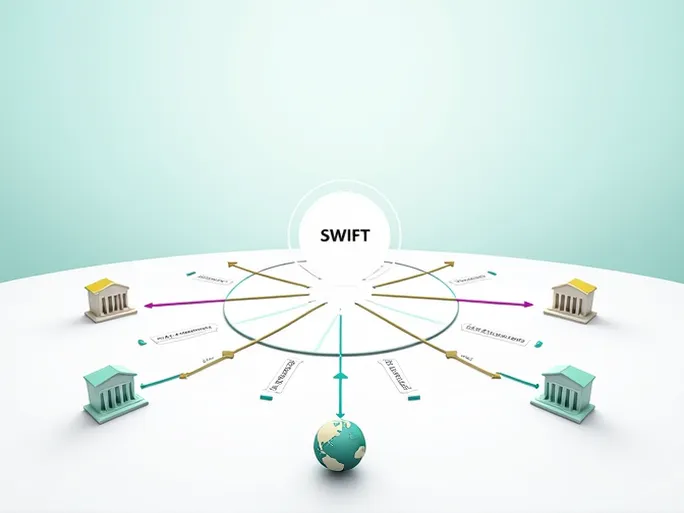

In today's globally interconnected world, international money transfers have become an indispensable financial activity. Whether for studying abroad, traveling, or conducting business with overseas partners, ensuring timely and secure fund transfers to designated accounts is a priority for individuals and businesses alike. However, many encounter challenges during the process, particularly in guaranteeing that funds reach their intended destination. This guide explains how using the correct SWIFT code can simplify your transfers, ensuring safe and efficient delivery while avoiding unnecessary complications.

Understanding SWIFT Codes: The Backbone of International Banking

For many, the term "SWIFT code" may seem unfamiliar, yet it plays a pivotal role in global financial transactions. A SWIFT code is a standardized identifier used by banks worldwide to facilitate cross-border transfers and communication. This unique code ensures funds are routed accurately to the correct bank and branch. Understanding its structure, purpose, and how to obtain it is crucial for seamless international transfers.

Take, for example, the SWIFT code for OTP BANKA D.D.: OTPVHR2XSPL . If you're sending funds to recipients in Split, Croatia, using this code guarantees the money reaches the intended account at the bank's branch located at Gundulićeva 36, Split, Splitsko-Dalmatinska, 21000. Verifying the code's accuracy and ensuring it matches the recipient's bank details is paramount.

Decoding the SWIFT Code Structure

A SWIFT code typically consists of 8 to 11 alphanumeric characters:

- First 4 letters: Bank identifier (e.g., "OTPB" for OTP Bank)

- Next 2 letters: Country code (e.g., "HR" for Croatia)

- Following 2 characters: Location code (e.g., "2X" for Split)

- Last 3 characters (optional): Branch identifier (e.g., "SPL" for a specific branch)

Breaking down OTPVHR2XSPL : "OTP" identifies the bank, "VHR" represents Croatia, "2X" denotes the location, and "SPL" specifies the branch. Since each bank and branch has a unique code, double-checking this information before initiating a transfer is critical.

Avoiding Common Pitfalls in International Transfers

Incorrect SWIFT codes can lead to delayed or misdirected funds, resulting in financial losses and logistical headaches. To mitigate risks:

- Confirm the SWIFT code directly with the recipient or through the bank's official website.

- Verify that the recipient's bank name matches the code exactly.

- Be aware of variations in fees, exchange rates, and processing times across countries and institutions.

Modern banking platforms—online portals, mobile apps, or third-party services—often provide SWIFT code assistance, streamlining the process. However, always use reputable and compliant channels to safeguard against fraud.

Legal and Security Considerations

International transfers are subject to regulatory frameworks, including limits on transfer amounts and currency controls. Research the destination country's policies to ensure compliance and retain transaction records for reference. Partnering with established financial institutions further enhances security, as they offer robust support systems and fraud prevention measures.

For transparency, cross-check the recipient's bank statement to confirm the transferred amount and SWIFT code alignment. Promptly notify the recipient once funds are sent to facilitate tracking.

Conclusion: Mastering SWIFT Codes for Effortless Transfers

Accurate SWIFT code usage is the cornerstone of successful international transactions. Whether for personal or business purposes, meticulous attention to detail ensures funds arrive securely and on time. By leveraging tools like OTP BANKA D.D.'s code ( OTPVHR2XSPL ) and adhering to best practices, you can navigate global finance with confidence, strengthening connections across borders without unnecessary stress.