In today's rapidly evolving global financial markets, cross-border transactions have become an indispensable part of daily operations for individuals and businesses alike. However, the complexity of international payments often leads to confusion. In this context, SWIFT/BIC codes serve as golden keys to unlocking international finance, ensuring funds move swiftly and securely across borders. When using OTP BANKA D.D. for remittances, understanding its SWIFT/BIC code—OTPVHR2XSIB—is particularly critical.

Understanding SWIFT/BIC Codes

The Society for Worldwide Interbank Financial Telecommunication (SWIFT) provides secure communication channels between financial institutions to facilitate smooth international transactions. The SWIFT/Bank Identifier Code (BIC) is a unique identifier that distinguishes banks and financial institutions globally. These codes enable banks to securely transmit payment instructions, ensuring funds reach their intended destinations accurately and efficiently.

Providing the correct SWIFT/BIC code is essential for international transfers. Errors in these codes may result in transaction delays or, in extreme cases, loss of funds.

Decoding OTP BANKA D.D.'s SWIFT/BIC: OTPVHR2XSIB

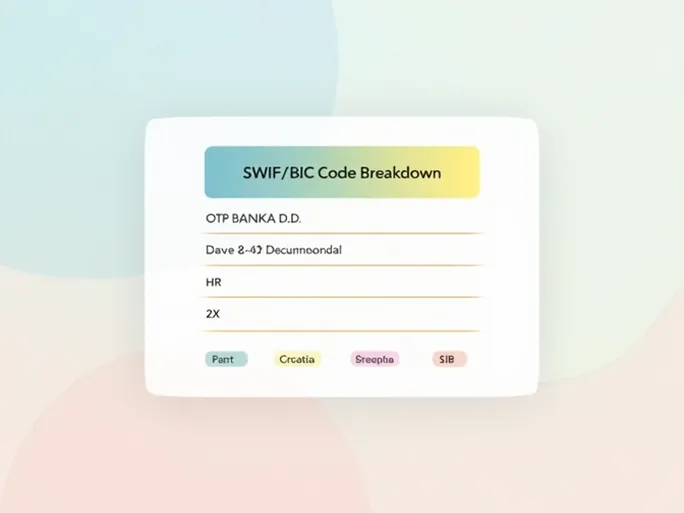

As a prominent Croatian bank, OTP BANKA D.D. operates with the SWIFT/BIC code OTPVHR2XSIB. This alphanumeric sequence contains specific information:

- OTPV represents the bank's unique identifier within the global financial system.

- HR denotes Croatia using the ISO 3166-1 country code, helping receiving banks identify the transaction's origin.

- 2X specifies the bank's location, providing additional geographic precision.

- SIB identifies the particular branch, ensuring funds reach the correct destination.

The Critical Importance of SWIFT/BIC Codes

In our interconnected financial landscape, accurate SWIFT/BIC codes serve multiple vital functions:

- Transaction Security : Correct codes prevent misdirected funds and safeguard financial transfers.

- Operational Efficiency : Accurate codes enable banks to process transactions rapidly, minimizing delays.

- Cost Reduction : Proper codes prevent repeated transfer attempts and associated fees.

- Trust Building : Standardized codes enhance confidence between transacting parties.

- Global Commerce Enabler : These codes form the backbone of international banking communications.

Best Practices for Using SWIFT/BIC Codes

To ensure successful international transfers:

- Verify codes against official bank documentation

- Confirm details with recipients before initiating transfers

- Maintain complete bank information including names and addresses

- Consult bank representatives when uncertain about code accuracy

Optimizing International Money Transfers

Additional strategies for seamless cross-border payments include:

- Preparing all required information in advance

- Using secure, reputable transfer channels

- Monitoring transaction status through bank tracking services

- Understanding applicable fees before initiating transfers

- Promptly addressing any issues that may arise

Conclusion

SWIFT/BIC codes play a pivotal role in international finance, ensuring security, efficiency, and cost-effectiveness in cross-border transactions. For users of OTP BANKA D.D., proper utilization of the OTPVHR2XSIB code provides assurance that funds will reach their intended destinations securely and promptly. Whether conducting personal or business transactions, accurate application of these financial identifiers remains fundamental to successful global money movement.