In international financial transactions, SWIFT/BIC codes serve as crucial identifiers that determine the success of fund transfers. The code COLOCOBMCTG, for instance, represents Bancolombia S.A., a significant player in the global financial system. Accurate identification of SWIFT codes not only enhances transaction efficiency but also prevents delays and complications arising from incorrect information.

Understanding SWIFT/BIC Code Structure

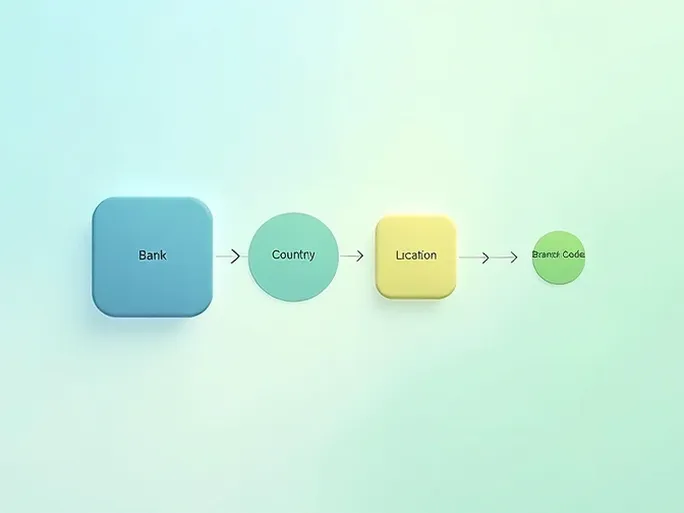

The composition of SWIFT/BIC codes follows a specific pattern that conveys essential information:

- Bank Code (COLO): These four letters uniquely identify Bancolombia S.A. within the financial network.

- Country Code (CO): The two-letter designation confirms the bank's location in Colombia, ensuring proper country routing.

- Location Code (BM): This segment pinpoints the bank's headquarters location, providing precise transaction routing.

- Branch Code (CTG): The final three characters specify particular branches. A termination with "XXX" indicates the bank's primary office.

Essential Verification Practices for International Transfers

When initiating international wire transfers, meticulous attention to SWIFT code accuracy proves vital. Financial experts recommend these verification steps:

- Bank Name Confirmation: Cross-check that the recipient bank name matches exactly with the SWIFT code's corresponding institution.

- Branch Verification: When using branch-specific codes, ensure alignment between the coded branch and the recipient's account location.

- Country Validation: Verify that the SWIFT code's country designation corresponds to the actual location of the recipient bank, particularly for multinational institutions with global branches.

Financial institutions worldwide process millions of transactions daily using this standardized system, which has become the backbone of international money movement since its establishment in 1973. The system's reliability stems from its precise coding structure and rigorous validation protocols maintained by the Society for Worldwide Interbank Financial Telecommunication.