In today's globalized economy, international money transfers have become essential for individuals and businesses conducting cross-border transactions. Whether paying for overseas education, travel expenses, or international purchases, accurate banking details are crucial. Any errors in this information can lead to transfer delays, additional fees, or even loss of funds. Understanding the basics of SWIFT/BIC codes is therefore an indispensable skill for anyone involved in international payments.

1. Understanding SWIFT/BIC Codes

The Society for Worldwide Interbank Financial Telecommunication (SWIFT) facilitates international financial transactions. The organization provides standardized codes—known as SWIFT codes or Bank Identifier Codes (BIC)—that uniquely identify banks worldwide. These codes contain important information about financial institutions.

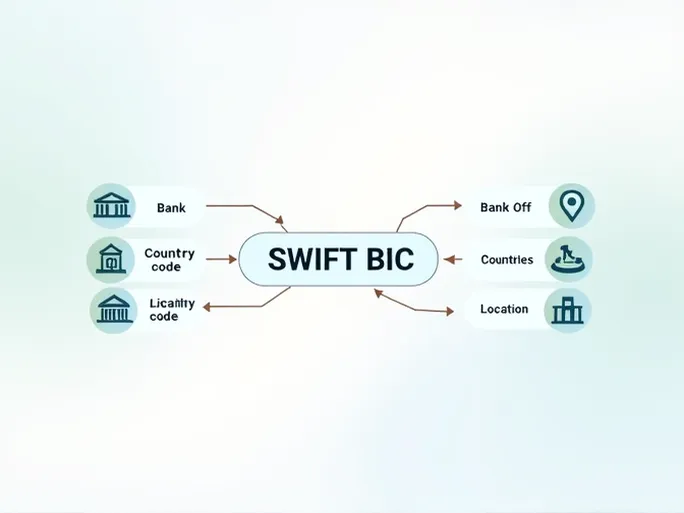

1.1 Code Structure Explained

A SWIFT/BIC code consists of 8 to 11 characters that convey specific information:

- Bank code: The first four characters identify the financial institution

- Country code: The next two characters indicate the bank's country

- Location code: Characters seven and eight specify the city, while optional characters nine through eleven identify particular branches

For example, ING-DIBA AG's SWIFT/BIC code is INGDDEFFPFA , where:

- INGD identifies ING-DIBA AG

- DE represents Germany

- FF indicates the bank's headquarters in Frankfurt

- PFA specifies a particular branch

2. SWIFT/BIC Code for ING-DIBA AG

ING-DIBA AG is a prominent German retail bank offering various financial services. When conducting international transfers to or from this institution, knowing its correct SWIFT/BIC code is essential.

2.1 Bank Information

- Bank name: ING-DIBA AG (Retail Banking)

- SWIFT/BIC code: INGDDEFFPFA

- Address: THEODOR-HEUSS-ALLEE 2, FRANKFURT AM MAIN

Users worldwide can utilize this code for secure and efficient fund transfers. Verifying these details before initiating any international transaction helps ensure successful fund delivery.

3. Important Considerations When Using SWIFT/BIC Codes

Accuracy is paramount when entering SWIFT/BIC codes for international transfers. Key considerations include:

3.1 Verifying Bank Names

Confirm that the bank name matches the provided SWIFT code exactly. Even minor discrepancies can cause transfer failures.

3.2 Checking Branch Details

When using branch-specific codes, ensure the recipient uses that particular branch. Differences between headquarters and branch codes may cause processing delays.

3.3 Confirming Countries

Verify that the SWIFT code's country matches the recipient's location, especially for banks operating across multiple nations.

4. Selecting a Transfer Service Provider

Choosing an appropriate money transfer service can save both time and money. Various providers offer different advantages for international transactions.

4.1 Competitive Exchange Rates

Some services provide more favorable exchange rates than traditional banks, potentially offering significant savings, especially for large transfers.

4.2 Transparent Fees

Reputable providers clearly disclose all applicable charges—including transfer fees and currency conversion costs—before transaction completion.

4.3 Faster Processing

Many modern services complete transfers within hours rather than days, providing quicker access to funds.

5. Frequently Asked Questions

5.1 How long do international transfers typically take?

Transfer duration varies by payment method, amount, and destination country. Some services complete transactions within hours.

5.2 How can I ensure fund security?

Select established transfer platforms that implement robust security measures like encryption and identity verification.

5.3 What are currency conversion fees?

These charges apply when converting between currencies during international transfers, with rates varying by provider.

6. Practical Application Example

Consider a German university student needing to transfer monthly tuition payments from a home country bank account to ING-DIBA AG:

- Confirm all banking details, including the correct SWIFT/BIC code

- Provide parents with complete transfer instructions, including reference numbers

- Verify all applicable fees before initiating the transfer

This approach helps ensure timely tuition payments while allowing students to focus on academic commitments.

7. Conclusion

Understanding and correctly using SWIFT/BIC codes is essential for international financial activities, whether for business, education, or personal purposes. These codes form a critical component of global banking infrastructure, and their accurate use helps prevent delays and complications in cross-border transactions.

Always verify banking details—particularly SWIFT/BIC codes—before initiating international transfers. Selecting appropriate transfer services can further enhance the efficiency and cost-effectiveness of global money movements.