In today’s globalized economy, cross-border money transfers have become a routine part of life for many individuals and businesses. Whether sending funds to family members overseas or completing international commercial transactions, selecting the right bank and using the correct SWIFT code are critical steps to ensure seamless transactions. Among financial institutions, QNB Bank Anonim Şirketi stands out for its reliable services and efficient fund transfer capabilities.

Understanding SWIFT Codes

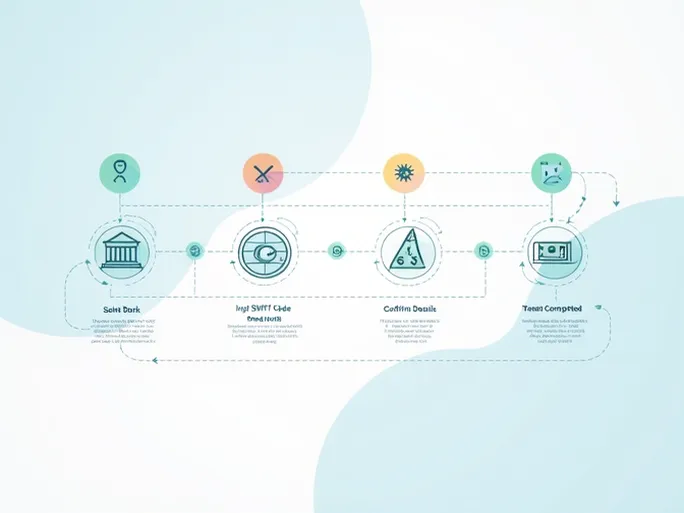

A SWIFT code (also known as a BIC code) is a unique identifier assigned to banks and financial institutions by the Society for Worldwide Interbank Financial Telecommunication (SWIFT). This code typically consists of 8 to 11 characters, with the first four letters representing the bank code, followed by country and location identifiers, and sometimes a branch code. The primary function of a SWIFT code is to ensure that international transfers reach the intended recipient bank accurately.

For customers using QNB Bank Anonim Şirketi for international transfers, the SWIFT/BIC code FNNBTRISADP is essential. Headquartered in Sakarya, Turkey, the bank offers a range of financial services tailored to individual and corporate needs. Inputting the correct SWIFT code minimizes errors and ensures funds are routed to the correct destination.

Key Details for Successful Transfers

In addition to the SWIFT code, providing complete recipient bank details is crucial. QNB Bank’s address in Adapazarı, Sakarya (ZIP code: 54100), along with the recipient’s account number, full name, and address, should be included to avoid delays or misdirected payments.

Transfer fees and exchange rates are equally important considerations. Financial institutions apply varying fee structures and exchange rate margins, which can significantly impact the final amount received. Customers are advised to confirm these details with QNB Bank before initiating a transfer to make informed financial decisions.

Timing and Security Considerations

International transfers typically take 1 to 5 business days, depending on intermediary banking processes, time zones, and regulatory reviews. For time-sensitive transactions, planning ahead is essential to avoid disruptions.

Security remains a top priority when transferring funds internationally. Reputable institutions like QNB Bank mitigate risks through robust operational protocols and customer support. Verifying the legitimacy of the recipient bank and understanding local regulations—such as documentation requirements for certain transfer purposes—can further safeguard transactions.

Proactive Communication

Maintaining open communication with your bank throughout the transfer process is highly recommended. Many banks, including QNB, offer online tracking tools to monitor transaction statuses in real time. Addressing questions or discrepancies promptly ensures smoother transactions and quicker resolutions.

By leveraging QNB Bank’s SWIFT code FNNBTRISADP and adhering to these guidelines, customers can execute secure, efficient cross-border transfers. Whether for personal or business purposes, attention to detail—from codes to fees—enhances the reliability of global financial transactions.