In today's globalized financial environment, international money transfers have become commonplace for both individuals and businesses. However, navigating the complexities of cross-border financial flows while ensuring security and timely delivery often proves challenging. The SWIFT/BIC code emerges as the essential solution to this challenge.

Fundamentals of SWIFT/BIC Codes

The SWIFT network, operated by the Society for Worldwide Interbank Financial Telecommunication, serves as an international financial messaging system. This network uses standardized codes to facilitate secure transactions between banks worldwide. The SWIFT/BIC (Bank Identifier Code) provides a unique identifier for each financial institution and its branches, ensuring accuracy in international transfers.

ING-DIBA AG, a prominent retail bank, utilizes the SWIFT code INGDDEFFTSY. This code contains specific information that becomes apparent when broken down into its constituent parts.

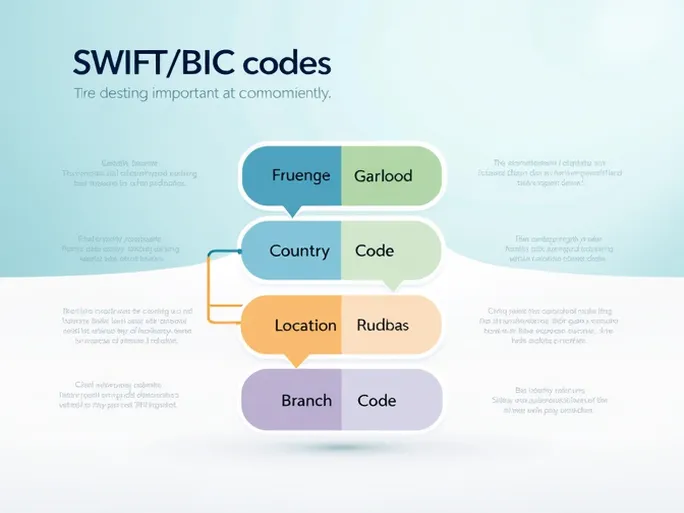

Decoding the SWIFT/BIC Structure

- Bank Code (INGD): The first four letters identify ING-DIBA AG as the financial institution.

- Country Code (DE): The subsequent two letters indicate Germany as the country of origin.

- Location Code (FF): The following two characters specify Frankfurt as the city location.

- Branch Code (TSY): The final three letters designate a specific branch. An 'XXX' ending typically indicates the institution's head office.

When is a SWIFT Code Required?

International transfers universally require SWIFT codes, whether sending or receiving funds. For transactions involving ING-DIBA AG, the correct SWIFT code (INGDDEFFTSY) must be used precisely to prevent delays or failed transfers.

Ensuring Successful International Transfers

Several critical considerations can optimize international money transfers:

- Verify bank details: Confirm the exact match between the entered bank name and the recipient's information.

- Confirm branch specifics: When transferring to particular branches, double-check the relevant SWIFT code.

- Check country codes: The country identifier within the SWIFT code helps verify the recipient bank's location.

Best Practices for SWIFT Code Usage

To maximize efficiency and security in international transactions:

- Utilize reputable financial services with established international transfer capabilities.

- Maintain communication with recipients to confirm all banking details before initiating transfers.

- Account for potential processing delays due to banking hours, intermediary banks, or public holidays.

The Critical Role of SWIFT/BIC Codes

In global finance, SWIFT/BIC codes serve as fundamental components for secure and accurate international transactions. Understanding these codes, such as ING-DIBA AG's INGDDEFFTSY, enables seamless cross-border financial operations for both personal and business purposes.