In today's globalized economy, international money transfers have become increasingly common. Whether supporting family members abroad or conducting international trade and investment, understanding the details of the transfer process is crucial. Among these details, the SWIFT code (also known as BIC code) plays a vital role in facilitating cross-border transactions.

What Is a SWIFT Code?

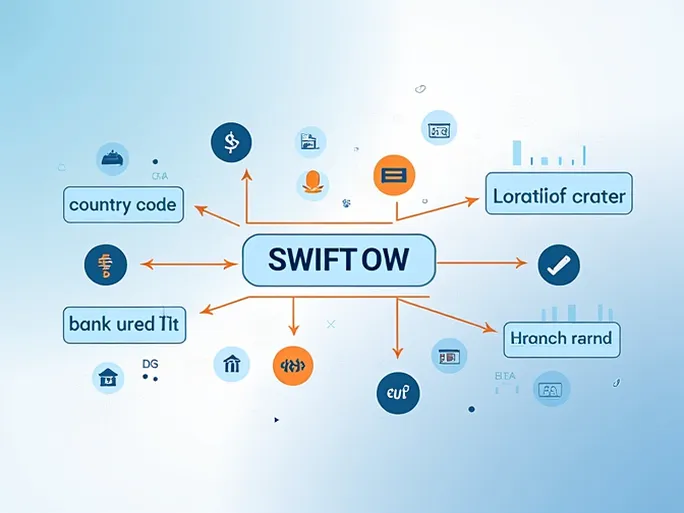

A SWIFT code is a bank identification code standardized by the Society for Worldwide Interbank Financial Telecommunication (SWIFT). Typically consisting of 8 to 11 characters, these codes contain information about the bank's name, country, location, and branch. They serve as a universal identifier for electronic transactions between banks and financial institutions, ensuring accurate information transfer and secure delivery of funds in international transactions.

Structure of SWIFT Codes

Taking ING-DIBA AG as an example, the bank's SWIFT code is INGDDEFFGPC. This code can be broken down into four components:

- Bank code (4 letters): "INGD" identifies ING-DIBA AG within the SWIFT network.

- Country code (2 letters): "DE" indicates Germany, following ISO 3166 standards.

- Location code (2 characters): "FF" specifies Frankfurt as the bank's headquarters location.

- Branch code (optional 3 characters): "GPC" identifies a specific branch. When omitted, funds are routed to the bank's head office.

Understanding this structure helps individuals and businesses verify banking information for efficient and secure international transfers.

Why SWIFT Codes Matter

SWIFT codes serve several critical functions in international banking:

- Transaction security: Correct codes minimize transfer errors and misdirected funds.

- Operational efficiency: The standardized system accelerates processing times between global banks.

- Transparency: Real-time tracking capabilities enhance visibility of fund movements.

- Universal acceptance: Nearly all international banks recognize SWIFT codes for global transactions.

How to Use SWIFT Codes for International Transfers

Follow these steps for successful international money transfers:

- Confirm the recipient's bank SWIFT code, noting that some banks use multiple codes.

- Accurately enter the SWIFT code in the designated field of your transfer form.

- Provide complete recipient details including name, account number, amount, and purpose.

- Select your preferred transfer method and review associated fees.

- Verify all information before submission and retain the transaction reference.

- Monitor the transfer status using your bank's tracking services.

Key Considerations

- Account for time zone differences that may affect processing times.

- Compare transfer fees across different service options.

- Monitor exchange rate fluctuations for currency conversions.

- Be aware of any transfer amount limits or frequency restrictions.

Understanding SWIFT codes and their application in international banking significantly enhances the efficiency and security of global money transfers. Whether for personal or business purposes, proper use of these codes ensures smooth cross-border financial transactions in our interconnected digital economy.