In international financial transactions, SWIFT/BIC codes serve as crucial components for ensuring seamless bank-to-bank transfers. The code INGDDEFFDOT, belonging to ING-DIBA AG (a retail bank), provides an excellent case study for understanding how these identifiers function.

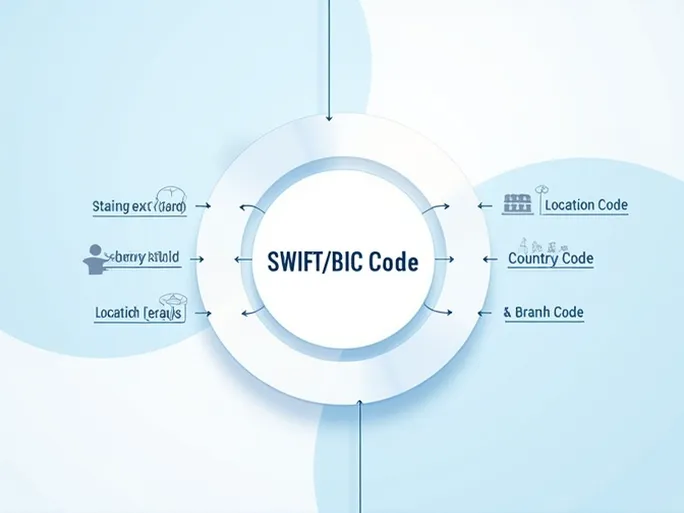

SWIFT/BIC codes typically consist of 8 to 11 characters, each segment carrying specific significance. The structure of ING-DIBA AG's code reveals important information about the financial institution:

- Bank Code (INGD): These four letters uniquely identify ING-DIBA AG, specifying the exact financial institution involved in the transaction.

- Country Code (DE): The two-letter country designation confirms the bank's registration in Germany.

- Location Code (FF): This segment pinpoints the bank's headquarters location within the country.

- Branch Code (DOT): The final three letters designate a specific branch of ING-DIBA AG. When a code ends with "XXX," it indicates the institution's head office.

The complete SWIFT/BIC code INGDDEFFDOT thus provides all necessary routing information for international transfers to ING-DIBA AG. Proper understanding of these identifiers helps customers execute cross-border payments efficiently while avoiding potential delays or additional charges caused by incorrect banking information.

Financial professionals emphasize the importance of verifying SWIFT/BIC codes before initiating international transactions. These standardized identifiers have become indispensable in global finance, ensuring accuracy and security in the trillion-dollar daily flow of cross-border payments.