When making international money transfers, many people find themselves confused by the various banking codes, fee information, exchange rates, and different bank and branch names involved. One crucial element in this process is the SWIFT/BIC code. What exactly is this code, and why is it so important? This article provides a detailed explanation to help you complete international transfers successfully.

What Is a SWIFT/BIC Code?

The SWIFT/BIC code is an international bank identifier used to recognize specific banks or their branches. SWIFT stands for the Society for Worldwide Interbank Financial Telecommunication. Established in 1973, this organization provides a secure and efficient messaging platform for global financial institutions. The SWIFT system ensures that banks worldwide can complete financial transactions quickly and accurately.

SWIFT/BIC codes typically consist of 8 to 11 characters in a standardized format. This structure enhances the security and efficiency of international transfers while reducing the risk of delays or financial losses due to input errors. Understanding these codes is essential for anyone conducting international transactions.

Structure of SWIFT/BIC Codes

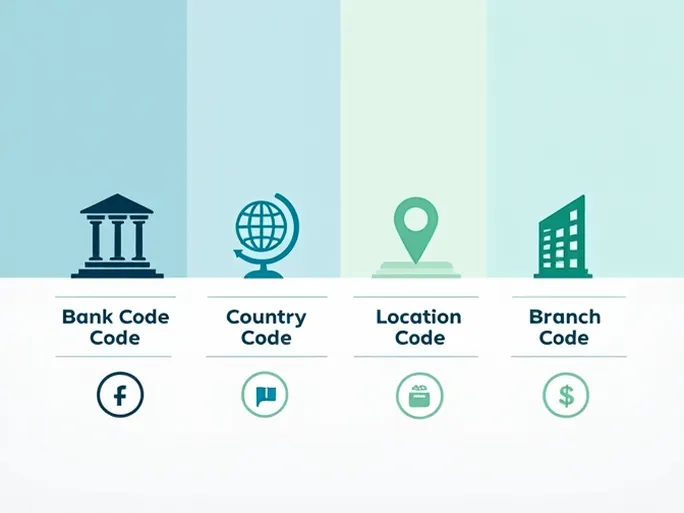

A standard SWIFT/BIC code contains the following components:

- Bank Code (4 letters): Identifies the specific bank (e.g., "BMC" for BANK OF AFRICA).

- Country Code (2 letters): Indicates the bank's country (e.g., "MA" for Morocco).

- Location Code (2 characters): Specifies the bank's headquarters or primary location, helping distinguish between branches in the same country.

- Branch Code (optional, 3 characters): Identifies specific branches. "XXX" typically denotes the bank's head office.

For example, BANK OF AFRICA's complete SWIFT/BIC code is "BMCEMAMCXXX." This standardized format ensures smooth international transfers.

How to Use SWIFT/BIC Codes for International Transfers

When preparing an international transfer, ensure you have the correct SWIFT/BIC code. Follow these key steps:

- Verify bank details: Confirm the recipient's bank name and SWIFT/BIC code with them directly if any information is unclear.

- Understand fees: Be aware of all applicable charges, including transfer fees and potential exchange rate markups.

- Check branch information: If sending to a specific branch, use that branch's SWIFT code.

- Ensure accuracy: Double-check all details, including recipient name, account number, and SWIFT code, as even minor errors can delay transfers.

- Select a transfer service: Compare different providers to find competitive exchange rates and low fees.

Why Choose Professional Transfer Services?

Professional money transfer services often provide significant advantages over traditional banks:

- Better exchange rates: Typically offer more favorable rates than major banks.

- Transparent fees: Clearly disclose all charges upfront.

- Faster processing: Many transfers complete within the same day.

- Customer support: Provide assistance for any questions during the transfer process.

Frequently Asked Questions

Conclusion

Correctly understanding and using SWIFT/BIC codes is essential for successful international money transfers. By learning about these banking identifiers and selecting appropriate transfer services, you can avoid common issues and ensure your funds reach their destination securely and efficiently.