In today's global financial landscape, the efficiency and convenience of international money transfers have become paramount. As the world economy continues to grow, cross-border fund flows between individuals and businesses have increased significantly, driving a surge in demand for international remittances. This is particularly evident in key financial hubs such as the British Virgin Islands (BVI), where the need for seamless transactions is critical. Ensuring that funds reach their intended accounts swiftly and securely is a universal priority, making it essential to understand the intricacies of international banking, particularly the use of SWIFT codes.

The Role of SWIFT Codes

A SWIFT (Society for Worldwide Interbank Financial Telecommunication) code, also known as a Bank Identifier Code (BIC), is a standardized format used to uniquely identify banks worldwide. Comprising 8 to 11 characters, the code structure includes the bank code (first four characters), country code (next two characters), location code (following two characters), and an optional branch code (last three characters for 11-digit codes). This standardized system ensures the accuracy and security of international transfers, enabling funds to be quickly identified and processed between banks.

For those planning to send money to Republic Bank in BVI, understanding its SWIFT code and its specific applications is indispensable. The primary SWIFT/BIC code for Republic Bank (BVI) is RBNKVGVGXXX , though the bank may use different codes depending on the transaction requirements or specific branches.

About Republic Bank (BVI)

Republic Bank (BVI) holds a prominent position in the BVI financial market, offering services such as personal and commercial banking, credit facilities, and foreign exchange. Known for its commitment to customer service and flexible financial products, the bank has attracted a diverse clientele, both domestic and international. It strives to provide efficient financial solutions tailored to the complexities of the modern global economy.

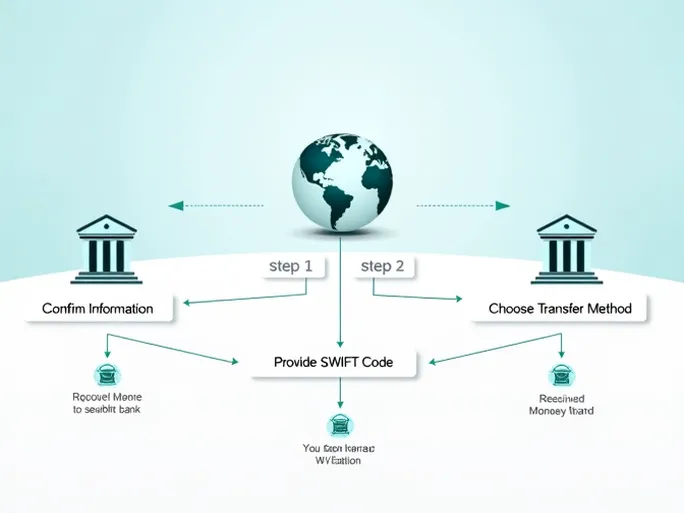

When initiating an international transfer, the following steps are typically involved:

- Verification of Transfer Details – Both the sender and recipient must ensure the accuracy of the SWIFT code, as this is critical to the successful completion of the transaction.

- Selection of Transfer Channel – Different banks and financial service providers may offer varying fees and processing times. Comparing multiple options is advisable to secure the best terms.

- Completion of Documentation – The sender must fill out a remittance application form, including details such as the transfer amount and the recipient's banking information. Providing the correct SWIFT code at this stage is particularly important.

Practical Applications of SWIFT Codes

1. Direct Transfers – When sending funds directly to Republic Bank (BVI), the SWIFT code RBNKVGVGXXX can typically be used. If no specific branch information is available, this code is generally sufficient for processing.

2. Centralized Processing – Some banks consolidate international transfers through a central branch or headquarters. Using a standardized SWIFT code simplifies the process and minimizes errors.

3. Updates and Changes – Financial institutions may periodically update their SWIFT codes to enhance efficiency and security. Before initiating a transfer, it is advisable to confirm the current code with Republic Bank (BVI) or the sender's bank.

Recipient-Side Requirements

For recipients, providing the following details to the sender is crucial:

- SWIFT/BIC Code – Ensure the code RBNKVGVGXXX is provided to direct funds to Republic Bank (BVI).

- Account Number – The recipient's bank account number must be clearly stated to avoid errors.

- Full Name and Address – The sender's bank may require the recipient's full name and address to prevent processing mistakes.

Common Issues and Solutions

International transfers may occasionally encounter challenges. Below are some common scenarios and their resolutions:

- Delayed Transfers – If funds are delayed, contacting the bank to inquire about the cause is recommended. Incomplete information or an incorrect SWIFT code may be the issue.

- Incorrect SWIFT/BIC Codes – An erroneous code may result in funds being returned or sent to the wrong institution. Verifying the code beforehand is essential.

- Transfer Fees – Fees can vary significantly between providers. Researching costs in advance helps avoid unexpected charges.

Conclusion

Understanding and correctly utilizing SWIFT codes is fundamental to executing seamless international transfers. In a dynamic financial hub like BVI, ensuring the security and timeliness of transactions is vital for maintaining financial liquidity and gaining a competitive edge in global commerce. Before initiating any transfer, verifying all details with the involved banks and confirming the latest SWIFT codes will safeguard the process. Should any questions arise when dealing with Republic Bank (BVI), seeking assistance through their customer service channels is a prudent step.