In international money transfers, SWIFT/BIC codes play an indispensable role. Have you ever experienced delays or complications due to an incorrect bank code? A valid SWIFT/BIC code not only ensures funds reach the intended account smoothly but also helps avoid unnecessary complications.

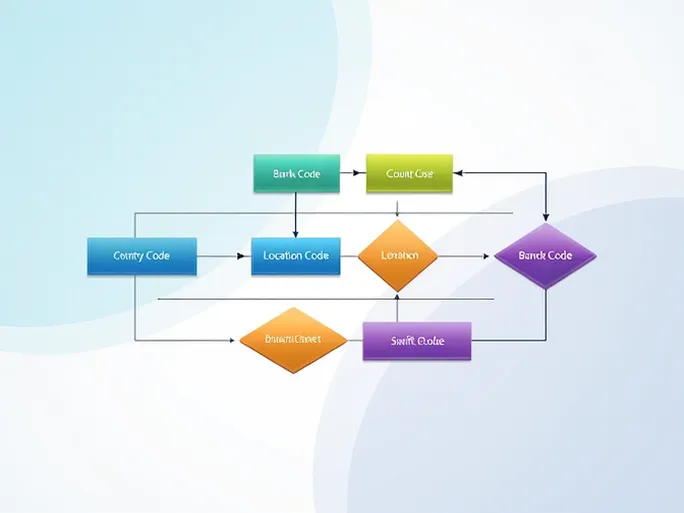

SWIFT/BIC codes typically consist of 8 to 11 alphanumeric characters, structured as follows:

- Bank Code (e.g., BMCE) : The first 4 characters identify the bank, such as BANK OF AFRICA.

- Country Code (e.g., MA) : The next 2 characters denote the bank’s country, in this case, Morocco.

- Location Code (e.g., MC) : These 2 characters specify the bank’s primary location.

- Branch Code (e.g., BTI) : The final 3 characters (optional) pinpoint a specific branch.

Notably, a SWIFT/BIC code ending with "XXX" indicates funds will be routed to the bank’s headquarters. Verifying the correct code before initiating a transfer minimizes risks of delays or misdirected payments.

Key Verification Steps Before Transferring Funds

To ensure a seamless transaction, cross-check the following details:

- Bank Name : Confirm the recipient’s bank name matches the SWIFT code.

- Branch : If using a branch-specific code, verify it aligns with the recipient’s branch.

- Country : Ensure the SWIFT code corresponds to the destination country.

Comparative analysis reveals that certain platforms offer more competitive exchange rates than traditional banks, enabling users to maximize the value of their transfers. By evaluating rates beforehand, senders can optimize cost efficiency without compromising transaction security or speed.