In today's globalized economy, international money transfers have become increasingly common. For both individuals and businesses, understanding the key elements of cross-border payments is essential. Among these, the correct use of SWIFT/BIC codes plays a pivotal role in ensuring secure and efficient fund transfers across the global banking network.

Understanding SWIFT/BIC Codes

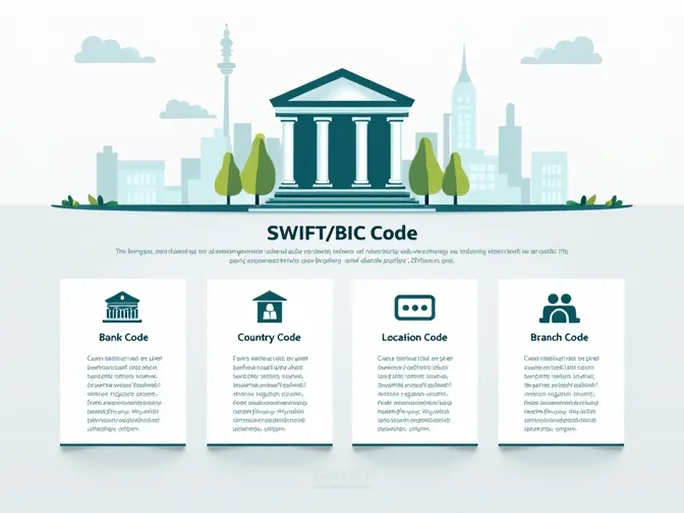

SWIFT/BIC codes, issued by the Society for Worldwide Interbank Financial Telecommunication (SWIFT), serve as standardized identifiers for financial institutions worldwide. Also known as Business Identifier Codes (BIC), these alphanumeric sequences facilitate accurate identification between banks during international transactions, minimizing errors and delays.

A typical SWIFT/BIC code consists of 8 to 11 characters, each carrying specific information about the financial institution. For example, the code "SBICIMDXXXX" breaks down as follows:

- Bank Code (SBIC): The first four characters identify the specific bank (STANDARD BANK ISLE OF MAN LIMITED).

- Country Code (IM): The next two characters denote the country (Isle of Man).

- Location Code (DX): These characters identify the bank's primary operating location.

- Branch Code (XXX): The final three characters specify a particular branch (XXX indicates the head office).

Key Information for STANDARD BANK ISLE OF MAN

For those transferring funds to STANDARD BANK ISLE OF MAN LIMITED, the following details are essential:

- SWIFT/BIC Code: SBICIMDXXXX

- 8-character SWIFT Code: SBICIMDX

- Bank Name: STANDARD BANK ISLE OF MAN LIMITED

- Address: STANDARD BANK HOUSE, DOUGLAS

Critical Verification Points for International Transfers

When initiating an international transfer using SWIFT codes, several verification steps can help prevent errors:

- Bank Name: Ensure exact matching with the recipient's bank name.

- Branch Information: Verify specific branch details when applicable.

- Country Verification: Confirm the SWIFT code's country matches the destination.

- Currency Specifications: Clarify acceptable currency types with the recipient bank.

- Complete Recipient Details: Gather all necessary information including account numbers and addresses.

Modern Transfer Solutions

Contemporary money transfer platforms offer significant advantages over traditional bank transfers, including:

- More competitive exchange rates

- Lower and more transparent fees

- Faster processing times

- Real-time tracking capabilities

Streamlined Transfer Process

The process for international money transfers through modern platforms typically involves:

- Account registration

- Input of recipient and banking details

- Selection of amount and currency

- Verification and confirmation

- Transaction tracking

As international financial transactions continue to grow in frequency and importance, understanding and correctly utilizing SWIFT/BIC codes remains fundamental to ensuring smooth, secure, and efficient cross-border money transfers.