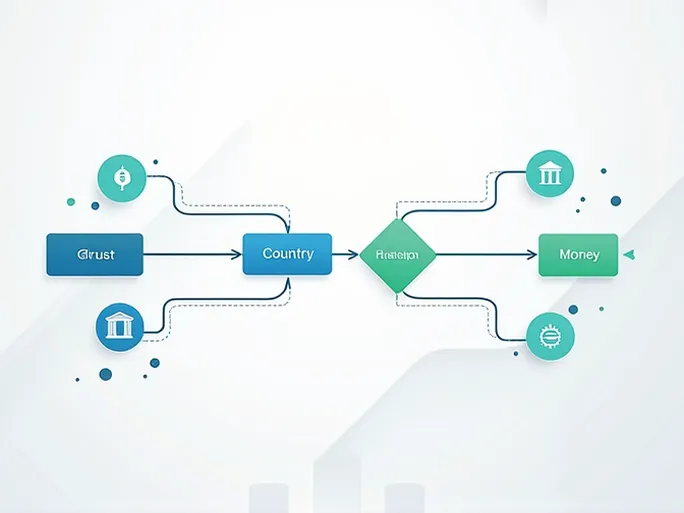

When sending money internationally, ensuring your funds reach the correct bank safely and accurately is paramount. This is where SWIFT/BIC codes play a crucial role. For example, Société Générale's SWIFT/BIC code is SOGEFRPPADB . Understanding this code is essential for seamless cross-border transactions.

What Does a SWIFT/BIC Code Contain?

A SWIFT code consists of 8 to 11 alphanumeric characters, structured as follows:

- First 4 characters : Bank code (e.g., SOGE for Société Générale)

- Next 2 characters : Country code (e.g., FR for France)

- Following 2 characters : Location code (e.g., PP for Paris)

- Optional last 3 characters : Branch identifier (e.g., ADB for a specific branch)

In the case of SOGEFRPPADB :

- SOGE identifies Société Générale.

- FR confirms the bank is in France.

- PP designates Paris as the financial hub.

- ADB specifies the particular branch.

Why Accurate SWIFT Codes Matter

Using the correct SWIFT/BIC code when transferring funds to institutions like Société Générale helps prevent potential issues during the transaction process. The SWIFT network facilitates secure communication between global banks, ensuring smooth and reliable international transfers.

However, a SWIFT code alone isn't enough for cross-border payments. Recipient details—including their full name, address, and account number—must also be provided accurately. Even minor errors in this information can lead to delays or lost transfers.

Key Takeaways

To safeguard your international transactions:

- Always verify the recipient's SWIFT/BIC code (e.g., SOGEFRPPADB for Société Générale).

- Double-check all recipient details before initiating a transfer.

- Confirm the code structure to ensure it matches the bank, country, and branch.

By paying attention to these details, you can minimize risks and ensure your funds reach their intended destination securely.