In today's globalized financial landscape, seamless connectivity between banks is essential. For individuals and businesses conducting international transfers, understanding and correctly using SWIFT/BIC codes has become increasingly critical. These codes not only simplify cross-border transactions but also ensure fund security and minimize errors. For clients transferring funds to Brazil, knowing Banco Santander (Brazil) S.A.'s SWIFT/BIC code is particularly vital.

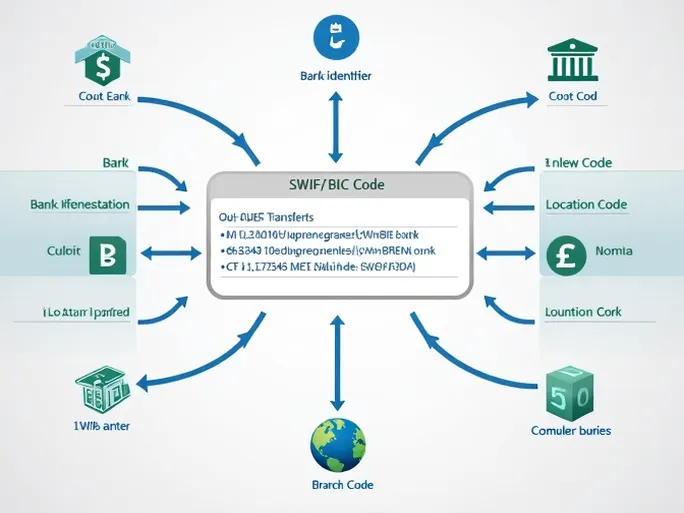

Understanding SWIFT/BIC Codes

SWIFT, which stands for the Society for Worldwide Interbank Financial Telecommunication, is an international standardized network for financial messaging. BIC, or Bank Identifier Code, serves as a unique identifier for financial institutions worldwide. The primary function of SWIFT/BIC codes is to help banks and financial institutions recognize each other globally, ensuring smooth fund transfers. In international transactions, these codes act as "addresses," directing funds to the correct bank and account.

Banco Santander (Brazil) S.A.'s SWIFT Code

For Banco Santander (Brazil) S.A., the SWIFT/BIC code is BSCHBRSPGEB . The first four characters, "BSCH," identify the bank. "BR" represents Brazil's country code, while "SP" indicates the bank's headquarters location in São Paulo. The complete SWIFT code typically consists of 8 to 11 characters, with "GEB" specifying the particular branch or department. This level of precision enhances transfer efficiency and reduces the risk of errors.

Key Considerations for International Transfers

While many clients focus on transfer fees during international transactions, the importance of accurate SWIFT/BIC codes cannot be overstated. Using the correct code helps prevent delays or loss of funds due to input errors, potentially saving clients from unnecessary financial losses.

For example, an incorrect SWIFT code might route funds to the wrong bank, requiring time-consuming recovery processes and additional costs. Therefore, verifying the latest SWIFT code before initiating any transfer is crucial.

Beyond the SWIFT code, clients should also carefully review:

- Transfer amount and currency

- Recipient's bank account details

- Any additional requirements from the banks involved

Different banks may have varying limits or requirements for transfers, so clients should confirm these details in advance. Exchange rate fluctuations can also affect the final amount received, making it advisable to consult financial experts for optimal timing.

Transfer Timelines and Security

Processing times for international transfers vary by institution, typically taking 1 to 5 business days. However, delays may occur depending on the countries involved. Clients should confirm processing times with their bank to plan accordingly.

Security is another critical factor. Modern banking offers multiple transfer methods:

- Online banking (ensure network security)

- Mobile applications

- ATM transactions

- In-person branch visits (with staff assistance to minimize errors)

Choosing a reputable bank like Banco Santander (Brazil) S.A., with its extensive domestic presence and international expertise, provides additional security for cross-border transactions.

Conclusion

When transferring funds to Banco Santander (Brazil) S.A., verifying the SWIFT/BIC code BSCHBRSPGEB is essential. By understanding the code's structure and the broader transfer process—while considering fees, timelines, and security—clients can ensure their funds reach the intended destination efficiently. Mastering these financial details provides a solid foundation for secure and seamless international transactions, benefiting both individuals and businesses engaged in global economic activities.