In today's highly globalized financial markets, communication and transactions between international banks have become increasingly complex. At the heart of this system, SWIFT/BIC codes serve as critical tools that enable banks worldwide to conduct cross-border payments and information exchange swiftly and securely. This article examines the structure and importance of SWIFT/BIC codes, along with practical guidance for their effective use, using Qatar National Bank as a case study.

Understanding SWIFT/BIC Code Structure

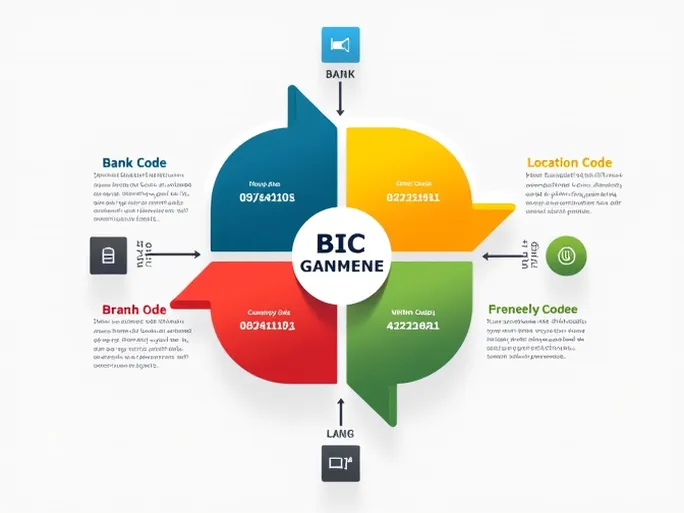

SWIFT/BIC codes consist of 8 to 11 characters that contain essential bank information, including the institution's name, location, and specific branch. The components break down as follows:

- Bank Code (BIC): Four letters identifying the specific bank. For Qatar National Bank, this appears as QNBA, representing the Qatari state-owned financial institution.

- Country Code: Two letters indicating the bank's home country. The QA code denotes Qatar, establishing the bank's geographic base.

- Location Code: Typically two characters specifying the bank's headquarters city. In Qatar National Bank's case, this also appears as QA, confirming all major operations reside within Qatar.

- Branch Code: Optional three additional characters that extend the code to 11 digits when present. For example, TRO identifies a specific Qatar National Bank branch, while XXX would indicate the head office.

When combined, Qatar National Bank's complete SWIFT/BIC code reads as QNBAQAQATRO.

The Critical Role of Accurate SWIFT/BIC Codes in International Transfers

Precision in SWIFT/BIC code usage proves vital for international money transfers. Incorrect codes may cause payment delays or even lost funds. To ensure successful transactions, consider these essential verification steps:

- Bank Name Verification: Confirm the SWIFT/BIC code matches the recipient bank's exact name. Discrepancies may route payments to incorrect institutions, potentially causing financial losses.

- Branch Specification: When using branch-specific codes, verify alignment with the recipient's actual branch. This becomes particularly crucial for large banks operating multiple branches across different cities, each with unique identifiers.

- Country Confirmation: Ensure the country code corresponds to the recipient bank's location. Erroneous country codes might divert funds to unintended foreign banks.

Optimizing International Money Transfers

Specialized money transfer services have emerged as superior alternatives to traditional bank transfers for cross-border payments, offering distinct advantages:

- Competitive Exchange Rates: These services typically provide more favorable rates than major banks, directly impacting the final received amount.

- Transparent Fee Structures: Clear disclosure of all charges before transaction confirmation helps users avoid unexpected costs.

- Expedited Processing: Many transfers complete within the same business day, significantly improving cash flow efficiency for both individuals and businesses.

Professional Support for International Transactions

Even experienced users occasionally require assistance with SWIFT/BIC code identification or transfer procedures. Reputable money transfer services maintain expert teams capable of providing personalized guidance throughout the transaction process, from initial inquiries to operational support.

Conclusion

Mastering SWIFT/BIC code usage represents a fundamental skill for successful international financial transactions, whether for personal or business purposes. By combining this knowledge with efficient money transfer solutions, users can achieve secure, cost-effective, and timely cross-border payments.