In today's globalized economy, international money transfers have become an essential part of both personal and business financial activities. When sending funds across borders, ensuring secure and efficient transactions is paramount. This is where SWIFT codes play a critical role in facilitating seamless international bank transfers. This article provides an in-depth look at how SWIFT codes function and specifically how to use BANCO NACIONAL DE MEXICO S.A.'s SWIFT code for international transactions.

Understanding SWIFT Codes

A SWIFT code (officially known as a BIC - Bank Identifier Code) is a standardized format defined by the Society for Worldwide Interbank Financial Telecommunication to uniquely identify financial institutions worldwide. These codes, ranging from 8 to 11 characters according to ISO 9362 standards, consist of four distinct components:

- Bank code: 4 letters representing the financial institution

- Country code: 2 letters identifying the country

- Location code: 2 alphanumeric characters specifying the city or headquarters

- Branch code (optional): 3 characters identifying a specific branch

For example, BANCO NACIONAL DE MEXICO S.A.'s SWIFT code BNMXMXMMLEO breaks down as follows:

- "BNMX" identifies BANCO NACIONAL DE MEXICO S.A.

- "MX" indicates Mexico as the country

- "MM" represents Mexico City as the headquarters location

- "LEO" specifies the Leon branch

The Critical Role of SWIFT Codes in International Transfers

SWIFT codes serve as the backbone of secure international financial transactions by providing a standardized identification system for banks worldwide. These codes ensure that funds reach their intended destination accurately and efficiently. Without the correct SWIFT code, transfers may experience significant delays or, in worst-case scenarios, funds could be lost entirely.

Beyond simple identification, the SWIFT network provides a secure messaging platform that enables financial institutions to exchange standardized financial transaction information. This system enhances transparency in cross-border transactions while minimizing potential errors.

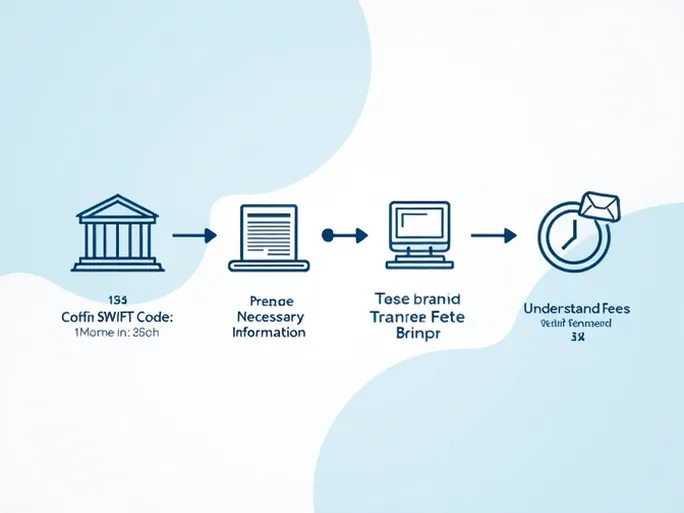

How to Use BANCO NACIONAL DE MEXICO S.A.'s SWIFT Code

To successfully transfer funds to BANCO NACIONAL DE MEXICO S.A., follow these key steps:

- Verify the SWIFT code: Confirm that BNMXMXMMLEO is the current code for your specific transaction requirements

- Gather recipient information: Collect the beneficiary's full name, account number, and complete address details

- Select transfer method: Choose between bank transfers, online banking platforms, or authorized payment service providers

- Understand fees and timing: Different institutions have varying processing times and fee structures for international transfers

Alternative International Transfer Methods

While SWIFT codes are the most widely recognized international transfer system, other options exist depending on the countries involved. These include:

- IBAN (International Bank Account Number) for European transfers

- ABA routing numbers for U.S. domestic transfers

- Local clearing systems like China's UnionPay network

Despite these alternatives, SWIFT transfers remain the most universally accepted method for international transactions, offering unparalleled security and reliability for cross-border payments.

Advantages and Limitations of SWIFT Transfers

Key Benefits:

- Enhanced security through encrypted financial messaging

- Global network encompassing nearly all major financial institutions

- Standardized message formats that reduce processing errors

Potential Drawbacks:

- Higher transaction fees compared to some alternative methods

- Processing times typically spanning several business days

- Complex system that may challenge inexperienced users

Conclusion

Understanding and correctly using SWIFT codes is fundamental to executing secure and efficient international money transfers. When dealing with Mexican financial institutions like BANCO NACIONAL DE MEXICO S.A., ensuring the accuracy of the SWIFT code BNMXMXMMLEO is particularly crucial for successful transactions.

International fund transfers require careful attention to detail, from verifying recipient information to understanding the associated costs and processing times. By mastering these elements, individuals and businesses can navigate the complexities of cross-border payments with confidence.