In the world of international money transfers, selecting the correct SWIFT/BIC code is crucial. Many have experienced the frustration of delayed or failed transactions due to incorrect banking information. Understanding codes like RBNKTTPAXXX can help prevent such issues and ensure funds reach their intended destination securely and efficiently.

Decoding the SWIFT/BIC Structure

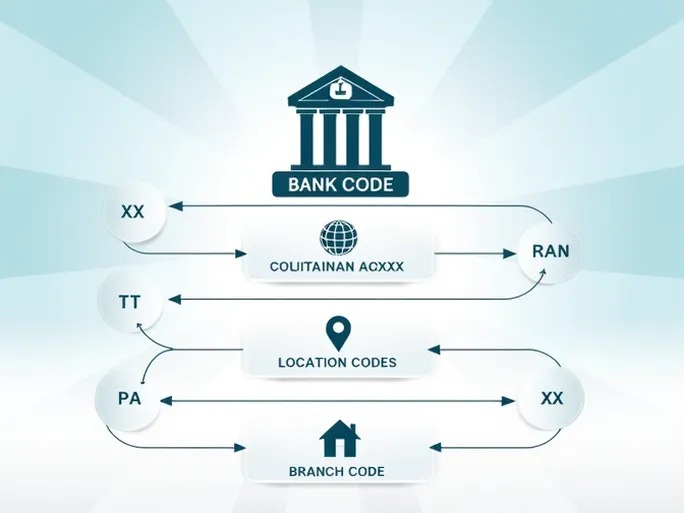

The RBNKTTPAXXX code consists of several key components that provide specific information about the receiving bank:

- Bank Code (RBNK): This four-letter combination uniquely identifies REPUBLIC BANK LIMITED.

- Country Code (TT): The two-letter designation for Trinidad and Tobago, indicating the destination country for the funds.

- Location Code (PA): These two letters specify the bank's headquarters location.

- Branch Code (XXX): The three-character ending identifies the bank's primary office rather than a specific branch.

Verification Steps for Secure Transfers

Before initiating any international transfer using a SWIFT code, financial experts recommend these verification steps:

- Confirm Bank Name: Double-check that the recipient's bank name exactly matches the institution associated with the SWIFT code.

- Verify Branch Information: When using a branch-specific code, ensure the physical address aligns with the recipient's banking details.

- Check Country Consistency: For multinational banks, confirm the SWIFT code corresponds to the correct country location.

Proper attention to these details significantly reduces the risk of transfer errors or delays. Financial institutions emphasize that accurate SWIFT/BIC information is the foundation of successful international banking transactions.