When transferring funds globally, have you ever considered the critical role of SWIFT/BIC codes? These alphanumeric identifiers are more than just technical jargon—they are the backbone of secure and efficient international transactions. Proper understanding of these codes can minimize errors and delays, ensuring your money reaches its intended destination without complications.

Decoding the Structure of SWIFT/BIC Codes

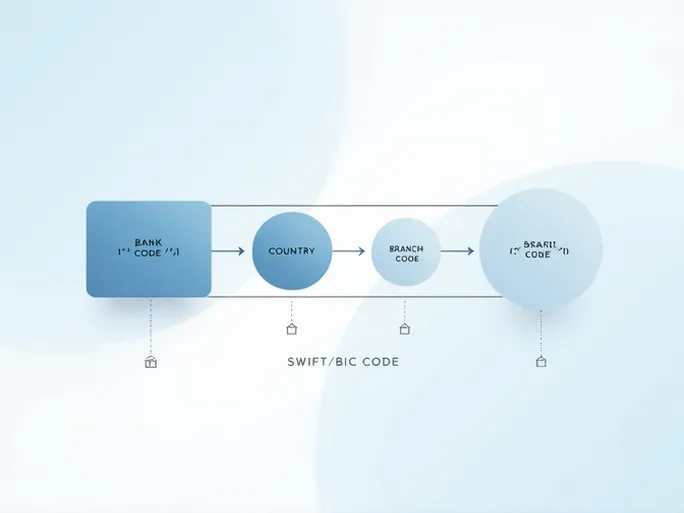

SWIFT/BIC codes typically consist of 8 to 11 characters, serving as unique identifiers for banks and their branches worldwide. Take SYDBANK A/S, for example, which uses the code SYBKDK22HER . This string can be broken down into four distinct components:

- Bank Code (SYBK): The first four letters represent the financial institution, in this case, SYDBANK A/S.

- Country Code (DK): The subsequent two letters indicate the bank's home country, Denmark.

- Location Code (22): These two characters pinpoint the bank's headquarters.

- Branch Code (HER): The final three letters specify a particular branch. When a code ends with 'XXX', it denotes the bank's primary office.

Practical Application: SYDBANK A/S Details

For SYDBANK A/S, the complete breakdown reveals:

- SWIFT Code: SYBKDK22

- Branch Code: HER

- Institution Name: SYDBANK A/S

- Address: DALGASGADE 22

- City: HERNING

Verification Steps for Error-Free Transfers

To guarantee smooth transactions, consider these essential checks before initiating an international transfer:

- Bank Name Accuracy: Confirm that the recipient's bank name matches the SWIFT code precisely.

- Branch Specifics: If using a branch-specific code, verify it aligns with the recipient's account details.

- Country Consistency: Ensure the country code corresponds to the actual destination of your funds.

Mastering the structure and application of SWIFT/BIC codes is indispensable for anyone conducting cross-border transactions. As demonstrated by SYDBANK A/S, meticulous attention to these details safeguards against errors and enhances the security of your financial transfers.