In today’s interconnected financial landscape, cross-border transactions have become an essential part of daily life. Yet, navigating the complexities of international wire transfers can be daunting, particularly when unfamiliar with banking codes such as SWIFT/BIC. This article provides a detailed breakdown of SYDBANK A/S’s SWIFT/BIC code to facilitate seamless global transactions.

What Is a SWIFT/BIC Code?

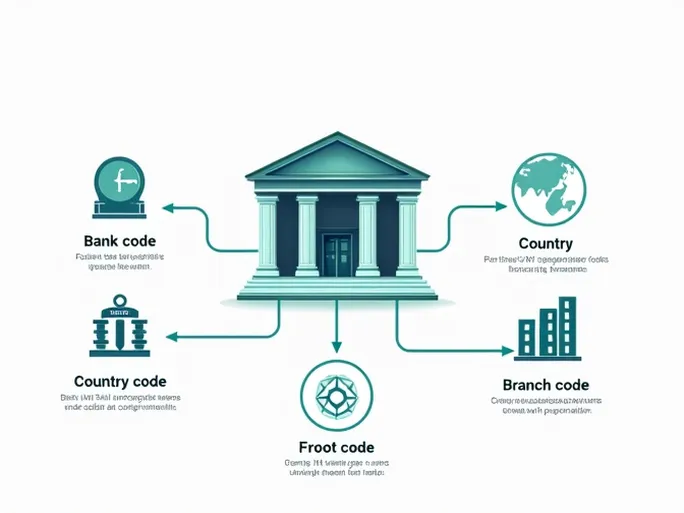

A SWIFT/BIC code is a unique identifier used in international banking to ensure accurate routing of funds between financial institutions. Comprising 8 to 11 alphanumeric characters, this code minimizes errors and delays in transactions. For SYDBANK A/S, the complete SWIFT/BIC code is SYBKDK22AAL .

Decoding the Structure

The components of SYDBANK A/S’s SWIFT/BIC code convey specific information:

- Bank Code (SYBK) : Identifies SYDBANK A/S as the financial institution.

- Country Code (DK) : Indicates Denmark as the bank’s home country.

- Location Code (22) : Specifies the bank’s headquarters.

- Branch Code (AAL) : Pinpoints the Aalborg branch for precise routing.

Key Considerations for International Transfers

To ensure smooth transactions, verify the following details before initiating a transfer:

- Bank Name : Confirm that the recipient’s bank name matches the one associated with the SWIFT/BIC code.

- Branch Code : If a specific branch is involved, cross-check its alignment with the recipient’s details.

- Country : Ensure the code corresponds to the correct destination, as many banks operate across multiple countries.

By adhering to these guidelines, users can mitigate potential issues and expedite cross-border payments.