In today's globalized financial landscape, international transfers have become a critical tool for individuals and businesses engaging in cross-border transactions. As economic interdependence deepens, the frequency and complexity of fund movements have increased significantly. However, many users face confusion when processing international transfers, particularly regarding the use of SWIFT/BIC codes. This article provides a detailed breakdown of SYDBANK A/S's SWIFT/BIC code, offering guidance to ensure smooth cross-border transactions while addressing key considerations for secure and efficient fund transfers.

The Fundamentals of SWIFT/BIC Codes

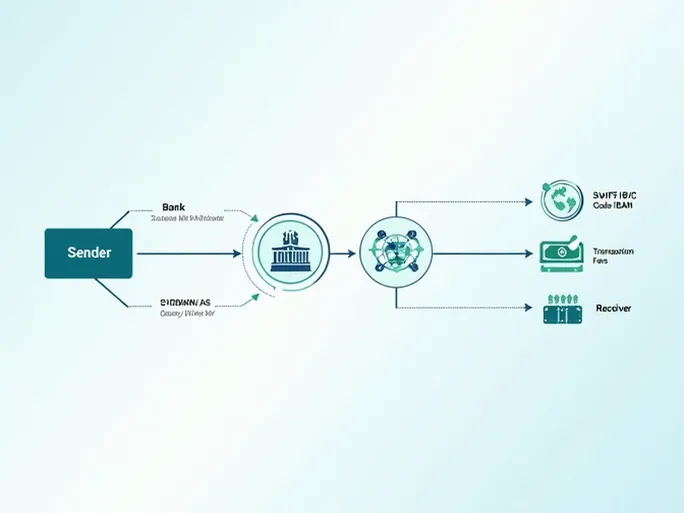

SWIFT (Society for Worldwide Interbank Financial Telecommunication) serves as a global financial messaging network that enables secure communication between banks worldwide. The SWIFT/BIC code functions as a unique identifier assigned to financial institutions, facilitating the accurate routing of international payments. These codes typically consist of 8 to 11 alphanumeric characters divided into distinct components: the first four characters represent the bank code, followed by two-character country and location codes, with an optional three-character branch code.

SYDBANK A/S's Specific Identifier

SYDBANK A/S operates with the SWIFT/BIC code SYBKDK22 AAL . This identifier enables precise recognition of the Danish financial institution within international payment networks. The bank's headquarters are located at Vingaardsgade 21, Aalborg, Region Nordjylland, 9000, Denmark. Providing accurate address details alongside the SWIFT code enhances processing efficiency and reduces potential delays in fund transfers.

Critical Considerations for International Transfers

Accuracy in providing SWIFT/BIC codes proves paramount for transaction security and processing speed. Even minor discrepancies in code entry can result in payment delays or misrouted funds. Financial institutions typically require both the recipient's SWIFT code and complete account details to execute international transfers. In European transactions, the International Bank Account Number (IBAN) often serves as a mandatory element alongside the SWIFT identifier.

Transaction requirements vary depending on transfer methods and amounts. While traditional bank transfers generally necessitate SWIFT codes, alternative payment platforms may operate through different verification systems. Users should verify specific requirements with their financial service providers before initiating transfers.

Cost and Processing Time Variables

International transfers involve variable fees and processing timelines influenced by multiple factors. Transaction costs typically depend on transfer amounts, currency exchange requirements, and intermediary bank charges. Processing durations generally range from one to five business days, affected by banking regulations, operational schedules, and potential system maintenance periods. Time-sensitive transfers may warrant premium services, though these options often incur higher fees.

Security Best Practices

Maintaining robust security measures remains essential for international financial transactions. Users should exclusively employ verified banking platforms and official websites when processing transfers. Secure network connections, particularly when accessing sensitive financial information, help prevent potential data breaches. Regular password updates and avoidance of public Wi-Fi networks for banking activities further enhance transaction security.

Understanding SYDBANK A/S's SWIFT/BIC code and associated transfer protocols enables efficient cross-border payments. Comprehensive knowledge of international banking procedures, including processing timelines, fee structures, and security protocols, contributes to successful global financial operations. As financial globalization continues to evolve, such understanding becomes increasingly valuable for both personal and commercial financial management.