When conducting international wire transfers, the SWIFT/BIC code serves as essential information for routing funds securely and efficiently. This alphanumeric sequence identifies both the recipient bank and its specific branch, facilitating smooth cross-border transactions.

1. Structure of SWIFT/BIC Codes

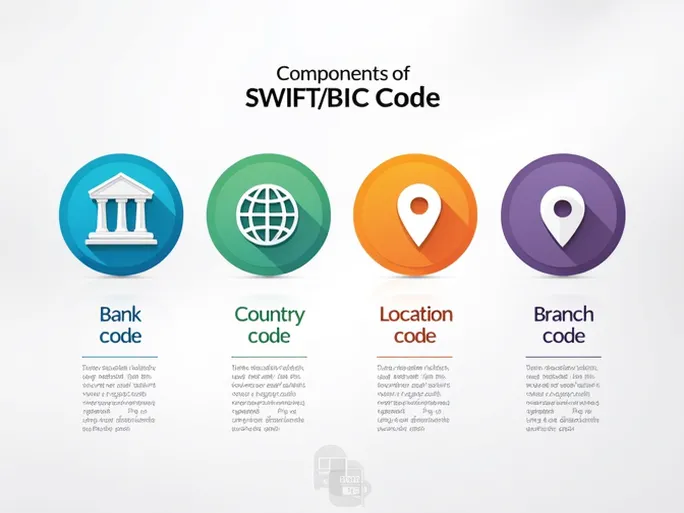

These standardized codes typically contain 8 to 11 characters, each segment conveying specific banking information:

- Bank code (SYBK) : The first four letters uniquely identify SYDBANK A/S.

- Country code (DK) : The two-letter ISO code designates Denmark as the bank's location.

- Location code (22) : These characters indicate the bank's headquarters geographical position.

- Branch code (AAR) : Optional three characters specify particular branches, with "XXX" representing the primary office.

2. SYDBANK A/S Identification Details

The complete banking information for SYDBANK A/S appears as follows:

- SWIFT code : SYBKDK22

- Branch code : AAR

- Institution name : SYDBANK A/S

- Headquarters address : KYSTVEJEN 29, AARHUS, Denmark

3. Verification Protocol for International Transfers

Prior to initiating any cross-border payment, financial institutions recommend triple-checking these critical details:

- Confirm the exact match between the SWIFT code and the beneficiary bank's registered name

- Validate branch-specific codes when transferring to subsidiary locations

- Cross-reference the country code with the destination bank's jurisdiction

Financial experts emphasize that accurate SWIFT information prevents transaction delays, additional fees, or potential misrouting of funds. Most banking institutions provide online verification tools to confirm these codes before processing international transfers.