In the global financial network, every step of an international money transfer requires careful attention, as even minor errors can lead to delays or mistakes. How can you ensure your funds are transferred safely and quickly to the intended account? The answer lies in understanding SWIFT/BIC codes.

Today, we examine the SWIFT/BIC code for ABANCA CORPORACION BANCARIA, S.A. — CAGLESMMVIG — to demonstrate how these codes help prevent potential issues in international transactions. Typically consisting of 8 to 11 characters, SWIFT/BIC codes precisely identify specific banks and their branches, ensuring accurate fund delivery.

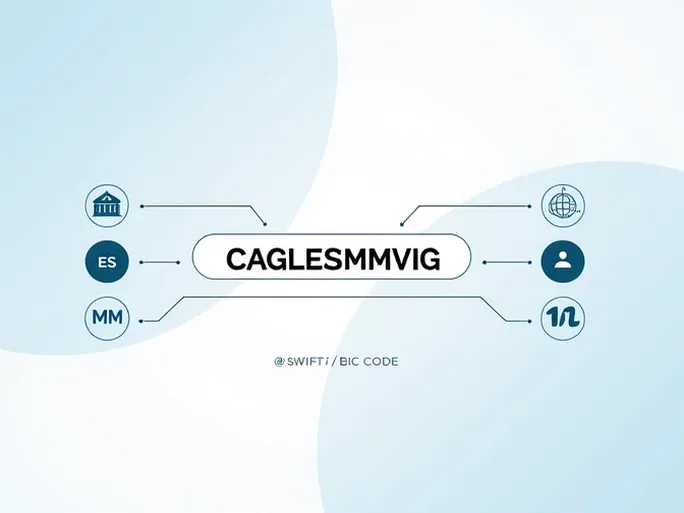

Decoding CAGLESMMVIG

Let's analyze the components of this SWIFT code:

- Bank Code (CAGL) : Identifies ABANCA, a prominent Spanish banking institution.

- Country Code (ES) : Indicates the bank's location in Spain.

- Location Code (MM) : Points to the bank's headquarters in Madrid.

- Branch Code (VIG) : The three-digit identifier for a specific branch (or 'XXX' for the head office).

The complete code CAGLESMMVIG directs transfers to ABANCA CORPORACION BANCARIA, S.A.'s main office at PS. RECOLETOS 4 in Madrid, while the 'VIG' ending specifies a particular branch. Using the correct code helps prevent delays caused by incorrect banking information.

Essential Verification Steps

Before initiating an international transfer, always verify these critical elements:

- Bank Name : Confirm the recipient's bank name matches exactly.

- Branch Confirmation : If using a branch-specific SWIFT code, double-check the branch details.

- Country Validation : Ensure the SWIFT code corresponds to the correct destination country to avoid cross-border errors.

Understanding SWIFT/BIC codes enhances both the efficiency and security of international money transfers. These standardized codes serve as reliable guides through the complex landscape of global financial transactions.