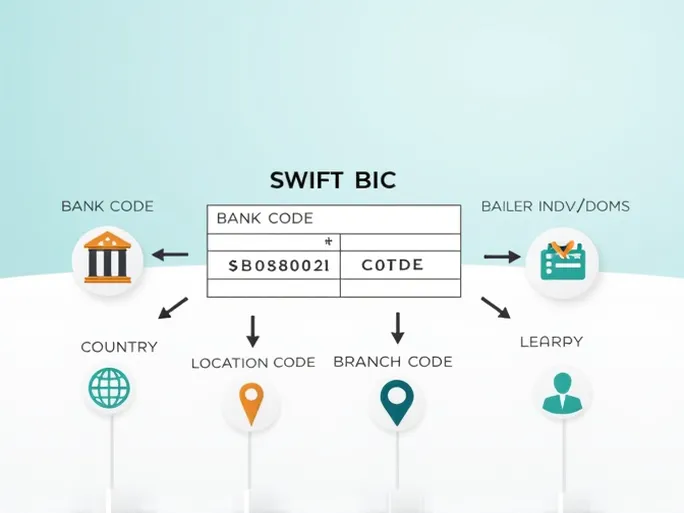

International money transfers require precise banking information to ensure funds reach their destination securely and efficiently. Among the most critical elements is the SWIFT/BIC code, an 8-11 character identifier that uniquely identifies banks and their branches worldwide.

QNB Bank Anonim Şirketi, as a major Turkish financial institution, follows the standard SWIFT/BIC code structure. The code can be broken down into four distinct components:

Decoding QNB Bank's SWIFT/BIC Structure

- Bank Code (FNNB): The first four characters identify QNB Bank specifically within the global banking network.

- Country Code (TR): The subsequent two letters indicate Turkey as the bank's home country.

- Location Code (IS): These two characters pinpoint the bank's headquarters location.

- Branch Code (AHL): The final three letters designate specific branches, with "XXX" representing the head office.

Essential Verification Steps Before Transferring

To prevent transfer delays or complications, several key details require verification:

- Confirm the recipient bank name matches exactly with the SWIFT code's associated institution

- Validate the branch information when using specific branch codes

- Ensure the country code corresponds with the destination country

Financial institutions typically offer more competitive exchange rates compared to traditional banks for international transfers. Many providers guarantee transparent fee structures and same-day processing for most transactions, prioritizing the sender's liquidity needs.

Understanding SWIFT/BIC codes and their proper application significantly reduces the risk of transfer issues. With accurate banking information and proper verification, international funds can be transferred securely and efficiently to their intended destinations.