In the vast landscape of global financial transactions, SWIFT/BIC codes serve as magical keys that enable smooth and secure international money transfers. If you've ever been involved in cross-border payments, you may have encountered the question: "What is BGFIBANK's SWIFT/BIC code?" This seemingly technical detail is actually a crucial element that ensures your funds move safely and arrive promptly at their destination.

Understanding SWIFT/BIC Codes

The SWIFT code, officially known as the Society for Worldwide Interbank Financial Telecommunication, was established in 1973. This system provides secure and efficient communication services between financial institutions worldwide, facilitating international transactions. BIC (Business Identifier Code) is simply another term for SWIFT code.

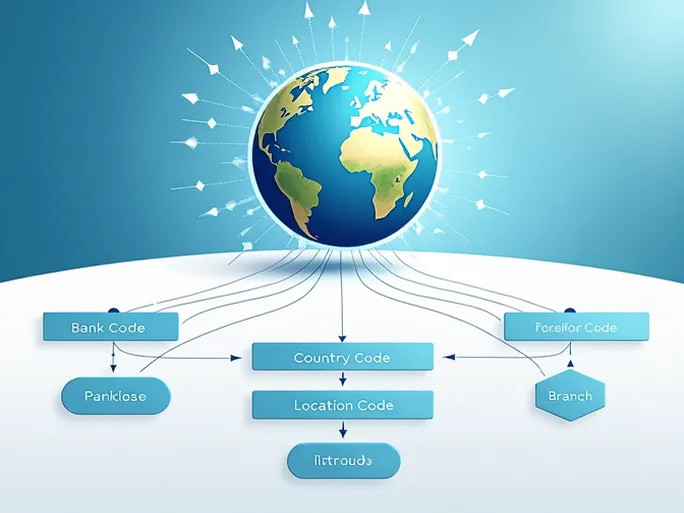

These codes typically consist of 8 to 11 characters following the ISO 9362 standard, containing vital information about financial institutions:

- Bank code: 4 letters representing the financial institution

- Country code: 2 letters indicating the bank's country

- Location code: 2 characters identifying the bank's city or region

- Branch code (optional): 3 characters specifying a particular branch

BGFIBANK's SWIFT/BIC Code: BGFIGALIPOG

For those conducting transactions with BGFIBANK, the complete SWIFT/BIC code is BGFIGALIPOG . Let's break down this important identifier:

- BGFI - The unique bank identifier for BGFIBANK

- GA - Country code for Gabon, where the bank is headquartered

- LI - Location code indicating Libreville, the bank's main office

- POG - Optional branch code for specific locations

Why SWIFT/BIC Codes Matter

These standardized identifiers play several critical roles in international finance:

- Security: Correct codes prevent funds from being sent to wrong recipients

- Efficiency: Accurate information ensures faster processing of transactions

- Transparency: Each transaction becomes traceable for auditing purposes

- Trust: Proper use builds confidence in international business relationships

Best Practices for Using SWIFT/BIC Codes

To ensure seamless international transactions:

- Double-check the bank's official name against the SWIFT code

- Verify branch codes when sending to specific locations

- Confirm the country code matches the destination

- Consult the bank's official sources for the most current information

- Stay updated on potential changes to banking codes

Conclusion

In today's interconnected financial world, understanding and correctly using SWIFT/BIC codes like BGFIBANK's BGFIGALIPOG is essential for secure and efficient international transactions. Whether you're making personal transfers or conducting business across borders, attention to these details ensures your funds reach their intended destination without unnecessary delays or complications.