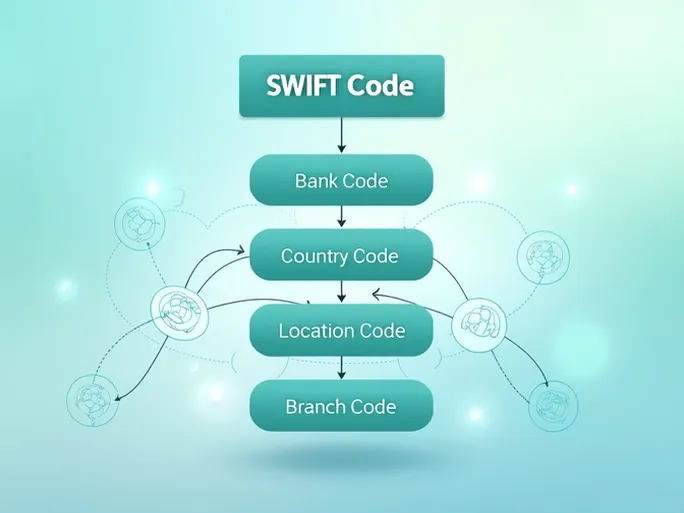

In global banking, the SWIFT/BIC code plays a crucial role in facilitating seamless international transactions. This 8- to 11-character code enables financial institutions to accurately identify specific banks and their branches. Below, we examine the structure of ASB BANK LIMITED’s SWIFT/BIC code to ensure smooth cross-border transfers without unnecessary delays.

Decoding ASB BANK LIMITED’s SWIFT/BIC Code

The complete SWIFT/BIC code for ASB BANK LIMITED is ASBBNZ2AITS , which breaks down as follows:

- Bank Code (ASBB) : The first four characters identify ASB BANK LIMITED.

- Country Code (NZ) : The next two letters indicate the bank’s location in New Zealand.

- Location Code (2A) : These two characters specify the bank’s headquarters.

- Branch Code (ITS) : The final three digits denote a specific branch. If a SWIFT code ends with "XXX," it typically refers to the bank’s primary office.

Key details associated with this code include:

- 8-Character SWIFT Code : ASBBNZ2A

- Branch Code : ITS

- Branch Name : ASB BANK LIMITED

- Address : ASB NORTH WHARF

- City : AUCKLAND

Ensuring Smooth International Transfers

To avoid errors or delays, verifying the following details is essential before initiating an international transfer:

- Confirm the Bank Name : Double-check that the recipient’s bank name matches the one associated with the SWIFT code.

- Verify the Branch : If using a branch-specific SWIFT code, ensure it corresponds to the recipient’s branch.

- Check the Country : SWIFT codes are country-specific; confirm the code aligns with the recipient bank’s location.

Understanding the structure and application of SWIFT/BIC codes enhances the efficiency of international transactions. As cross-border banking continues to expand, mastering these details is indispensable for individuals and businesses alike. Accuracy in every step ensures successful and hassle-free global payments.