When conducting international wire transfers, selecting the correct SWIFT/BIC code is crucial for ensuring funds reach their intended destination securely and efficiently. This article examines the SWIFT/BIC code structure for Banco Mercantil del Norte (BMN), a prominent Mexican financial institution.

Banco Mercantil del Norte's SWIFT/BIC Code

Banco Mercantil del Norte, S.A., Institución de Banca Múltiple, Grupo Financiero Banorte operates with the SWIFT/BIC code MENOMXMTDER . Headquartered in Monterrey, Nuevo León, Mexico, the bank provides comprehensive financial services to both individual and corporate clients.

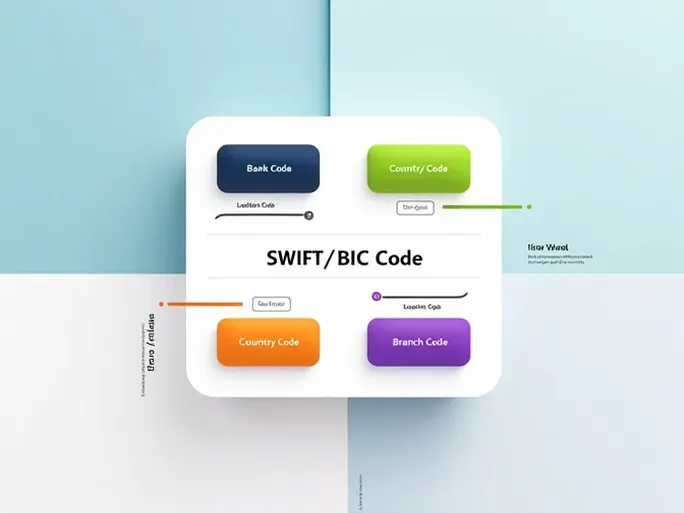

Decoding the SWIFT/BIC Structure

SWIFT/BIC codes consist of 8 to 11 alphanumeric characters that uniquely identify financial institutions worldwide. The components of MENOMXMTDER are:

- MENO - Bank code (identifies Banco Mercantil del Norte)

- MX - Country code (Mexico)

- MT - Location code (specifies the city or region)

- DER - Branch code (identifies a specific branch)

Best Practices for International Transfers

Verifying the accuracy of SWIFT codes before initiating transactions helps minimize errors and accelerates processing times. Financial institutions typically provide this information through official channels, including their websites.

Transaction security and speed remain paramount considerations for international transfers. Comparing service providers based on transfer fees, processing times, and exchange rates enables customers to make informed decisions.

Understanding SWIFT/BIC code composition and application facilitates smoother cross-border transactions. Whether for personal or business purposes, proper use of these identifiers ensures funds are routed correctly through the global banking network.