Have you ever felt confused by the complexities of international money transfers, particularly those cryptic SWIFT/BIC codes? While these alphanumeric sequences may seem like insignificant details, they are in fact the backbone of seamless global financial transactions. Take, for example, the Italian bank BANCA MONTE DEI PASCHI DI SIENA S.P.A., whose SWIFT/BIC code is PASCITM1MI8. This code is far more than a random string of characters—it holds critical information that ensures your money reaches its intended destination.

Breaking Down the SWIFT/BIC Code

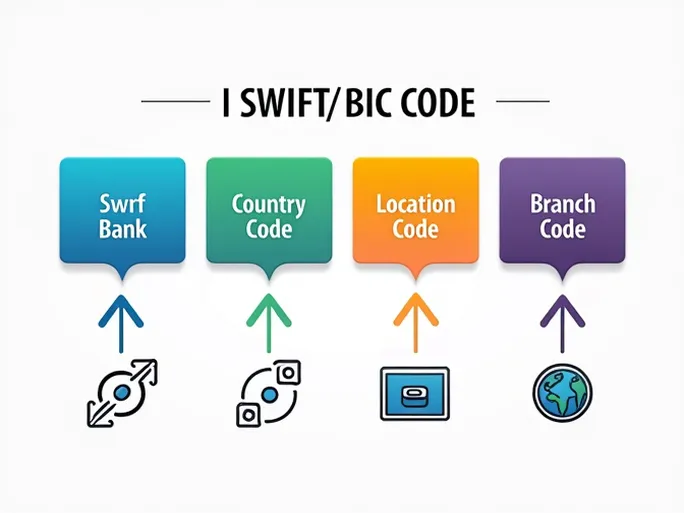

Let’s dissect the components of this code to understand its significance:

- Bank Identifier Code (BIC): The first four letters, "PASC," uniquely identify the bank—in this case, BANCA MONTE DEI PASCHI DI SIENA S.P.A.

- Country Code: The next two letters, "IT," indicate the bank’s location in Italy.

- Location Code: The following two characters, "M1," specify the bank’s precise location within Italy.

- Branch Code: The final three characters, "MI8," pinpoint the specific branch. If the code ends with "XXX," it typically refers to the bank’s headquarters.

Why Accuracy Matters

Understanding the structure of SWIFT/BIC codes is essential for ensuring the accuracy of international transfers. Using an incorrect code when sending money to BANCA MONTE DEI PASCHI DI SIENA S.P.A.—or any other bank—can lead to delays or even financial complications. To avoid such issues, always verify the following before initiating a transfer:

- Bank Confirmation: Double-check that the bank name matches the recipient’s financial institution.

- Branch Confirmation: Ensure the SWIFT code corresponds to the correct branch where the recipient holds their account.

- Country Confirmation: Confirm that the country indicated in the SWIFT code aligns with the recipient’s bank location.

Ensuring a Secure Transfer

To safeguard your funds, consider using reputable international transfer services. These platforms often offer competitive exchange rates, low fees, and efficient processing times. Additionally, their customer support teams can provide assistance if any issues arise during the transaction.

In summary, the correct SWIFT/BIC code is not merely a technicality—it is the linchpin of a successful international transfer. By mastering this seemingly small detail, you can enhance the efficiency of your transactions and protect your financial assets.