In global financial transactions, accurate SWIFT/BIC codes serve as the cornerstone for seamless fund transfers. For clients conducting international remittances with MEGA International Commercial Bank Co., Ltd., understanding the correct SWIFT/BIC code is particularly crucial.

Understanding SWIFT/BIC Codes

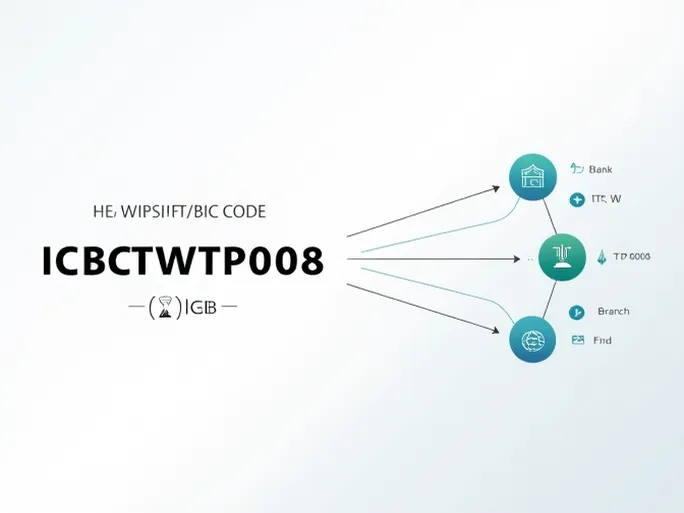

A SWIFT/BIC code is an 8-11 character alphanumeric combination that uniquely identifies banks and branches worldwide. For MEGA International Commercial Bank, the code is ICBCTWTP008, which can be broken down into distinct components:

- Bank Code (ICBC) : The first four letters identify the specific financial institution.

- Country Code (TW) : The following two letters designate Taiwan as the bank's location.

- Location Code (TP) : These two characters indicate the bank's headquarters.

- Branch Code (008) : The final three digits specify a particular branch.

Notably, SWIFT codes ending with "XXX" represent a bank's headquarters. Using incorrect codes may cause transaction delays or other complications, making verification essential for international transfers.

Verification Checklist for International Transfers

Before initiating transfers, clients should confirm:

- Bank Name : Ensure the recipient bank matches the account holder's financial institution.

- Branch Information : When using branch-specific codes, verify the branch corresponds to the recipient's account.

- Country : Confirm the SWIFT code aligns with the destination country, as banks operate across multiple nations.

Minimizing Transaction Risks

Understanding SWIFT/BIC code structure significantly reduces financial risks and enhances transfer efficiency. Proper verification of bank, branch, and country information prevents processing delays, ensuring secure and efficient cross-border transactions for both individuals and businesses.