In the realm of international money transfers, the accuracy of SWIFT/BIC codes is paramount. An incorrect code can lead to delays, complications, or even failed transactions. Understanding the structure and significance of these codes, such as the one for ABANCA CORPORACION BANCARIA, S.A., can streamline cross-border payments and minimize risks.

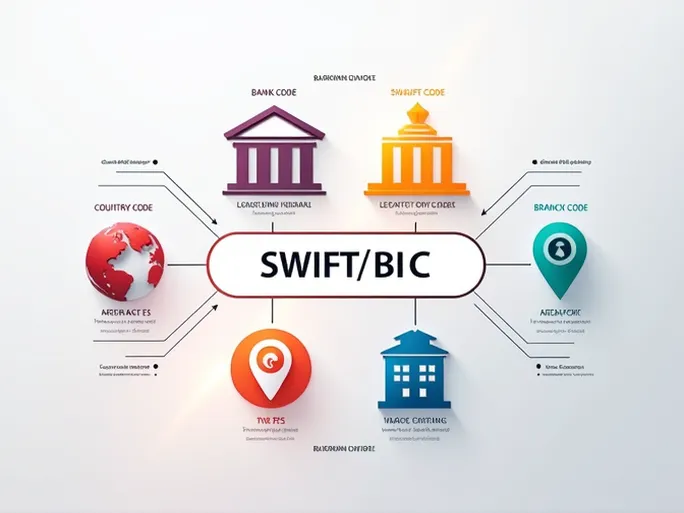

Decoding the SWIFT/BIC Structure

A SWIFT/BIC code consists of 8 to 11 alphanumeric characters that uniquely identify banks and their branches worldwide. For instance, ABANCA's code— CAGLESMMVOP —breaks down as follows:

- Bank code (CAGL) : The first 4 letters represent ABANCA CORPORACION BANCARIA, S.A.

- Country code (ES) : The next 2 letters designate Spain as the bank's home country.

- Location code (MM) : These 2 characters pinpoint the bank's headquarters.

- Branch code (VOP) : The optional final 3 characters specify a particular branch.

Essential Verification Steps

Before initiating an international transfer, thorough verification is crucial to avoid errors:

- Bank name confirmation : Cross-check that the recipient's bank name matches the SWIFT code provider.

- Branch validation : If using a branch-specific code, ensure it aligns with the recipient's designated branch.

- Country consistency : Verify that the SWIFT code corresponds to the recipient bank's actual country, as multinational banks operate across borders.

Precision in these details safeguards against transfer disruptions and optimizes processing time. Financial institutions emphasize that even minor discrepancies—such as a single misplaced character—can reroute funds or trigger compliance reviews.

As global transactions continue to rise, the standardized SWIFT/BIC system remains a cornerstone of international banking. Its alphanumeric precision enables trillions in annual cross-border payments while maintaining security protocols. For businesses and individuals alike, mastering this system is key to seamless financial operations across jurisdictions.