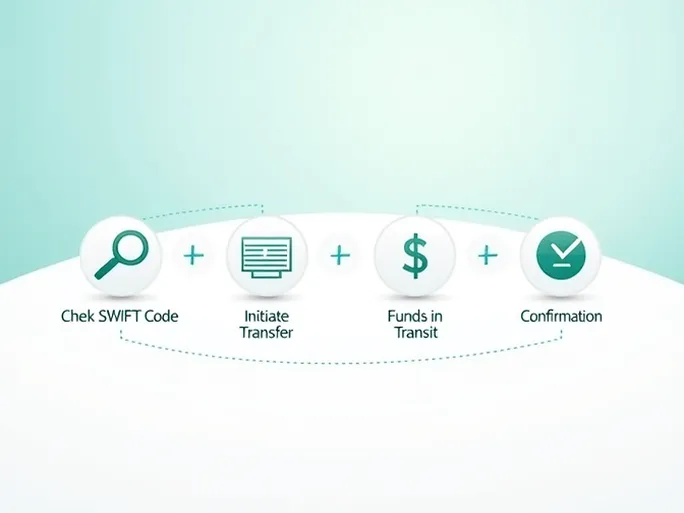

In today's globalized economy, cross-border transactions have become an indispensable part of financial activities for both individuals and businesses. The efficiency of international money transfers directly impacts global trade and personal financial flexibility. At the heart of this process lies the SWIFT code—a standardized identifier that ensures secure and accurate fund transfers across borders.

Understanding SWIFT Codes and Their Importance

The SWIFT (Society for Worldwide Interbank Financial Telecommunication) network serves as a secure messaging system for financial institutions worldwide. A SWIFT code, also known as a Bank Identifier Code (BIC), is a unique alphanumeric sequence that identifies specific banks and their branches. Typically comprising 8 to 11 characters, the code breaks down as follows:

- First 4 characters: Bank code

- Next 2 characters: Country code

- Following 2 characters: Location code

- Optional last 3 characters: Branch identifier

The accuracy of SWIFT codes cannot be overstated in international transactions. Even minor errors can result in funds being misdirected, delayed, or lost entirely. Verifying these codes is therefore essential for protecting financial assets.

ABANCA's SWIFT Code and Operational Details

ABANCA CORPORACION BANCARIA, S.A., a prominent Spanish financial institution headquartered in A Coruña, utilizes the SWIFT code CAGLESMM LCO for international transfers. The bank's processing center is located at:

Centro Proceso de Datos de ABANCA, Parc. F1, 15190 A Coruña, Spain

This precise identification ensures that funds reach their intended destination efficiently and securely, demonstrating how SWIFT codes serve as both routing tools and security measures in global finance.

Essential Precautions When Using SWIFT Codes

While SWIFT codes facilitate international transactions, users should observe these critical precautions:

- Verify bank and code alignment: Confirm that the SWIFT code matches the recipient bank's official name to prevent processing errors.

- Specify branch details: For banks with multiple branches, ensure the SWIFT code corresponds to the exact branch where the recipient holds their account.

- Confirm country information: Cross-check that the SWIFT code's country designation matches the recipient bank's location.

- Gather supplementary data: Collect additional recipient information including full name, account number, and bank address to facilitate smooth processing.

- Utilize digital verification: Many banks now offer online tools to validate SWIFT codes before initiating transfers.

Advantages of the SWIFT Network in Global Transactions

The SWIFT system offers several key benefits for international fund transfers:

Security: Advanced encryption protocols protect sensitive financial data from interception or alteration during transmission.

Speed: Transactions that previously took days can now be completed within seconds, significantly improving operational efficiency.

Global reach: With connectivity to thousands of financial institutions worldwide, SWIFT enables seamless cross-border transactions across most major markets.

Transparency: The system provides real-time tracking capabilities, allowing users to monitor transaction status throughout the transfer process.

Conclusion: The Indispensable Nature of SWIFT Codes

As international financial activities continue to expand, proper use of SWIFT codes remains fundamental to secure and efficient cross-border transactions. The case of ABANCA's SWIFT code CAGLESMM LCO illustrates how these identifiers serve as critical components in global banking infrastructure. By meticulously verifying SWIFT information and understanding its proper application, individuals and businesses can ensure their international transfers proceed smoothly and securely.