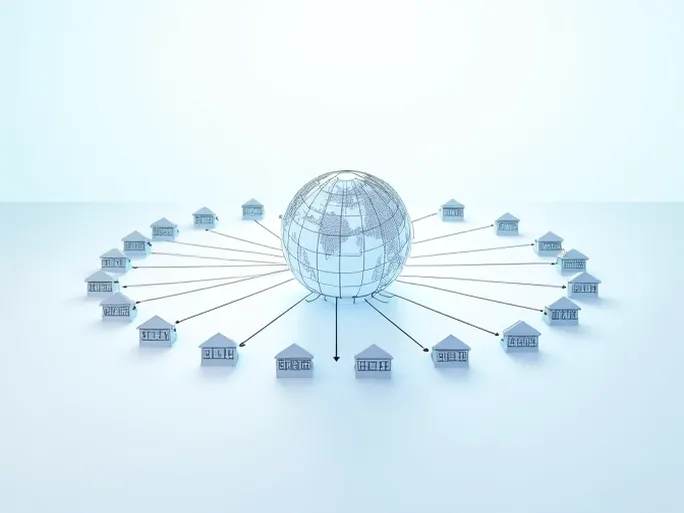

In today's global financial landscape, cross-border money transfers have become increasingly commonplace. Yet many individuals remain unaware of the mechanisms that ensure their funds reach the intended financial institution accurately and securely. At the heart of this process lies the SWIFT/BIC code system - an essential component of international banking operations.

The SWIFT code ROYCCAT2MIC serves as the unique identifier for Royal Bank of Canada (RBC), one of North America's leading financial institutions. Headquartered at the International Trade Centre, 1 Place Ville Marie, Montreal, Quebec H3B 4A7, this Canadian banking giant requires the precise use of its SWIFT code for all international transactions. Proper utilization of these codes not only facilitates smooth fund transfers but significantly reduces the risk of processing delays or misdirected payments.

SWIFT codes provide senders with a standardized method to ensure their transfers reach the correct financial institution. Many transaction errors originate from insufficient understanding of these codes, particularly among individuals conducting their first international transfers. When sending funds to Royal Bank of Canada through the SWIFT network, ROYCCAT2MIC must be used as the exclusive identification marker.

The practical application of SWIFT codes remains straightforward. Financial institutions recommend verifying all transfer details before initiating transactions, including the recipient bank's name, physical address, and correct SWIFT code. Most banking interfaces will prompt users for this information during the transfer process. Should any uncertainties arise, customers are advised to consult their bank's customer service representatives to confirm details before proceeding with the transaction.

As international financial transactions continue their upward trajectory, understanding fundamental elements like SWIFT codes becomes increasingly valuable. Proper utilization of identifiers such as ROYCCAT2MIC contributes to more efficient global money movement while providing individuals with greater confidence in managing their cross-border financial activities.