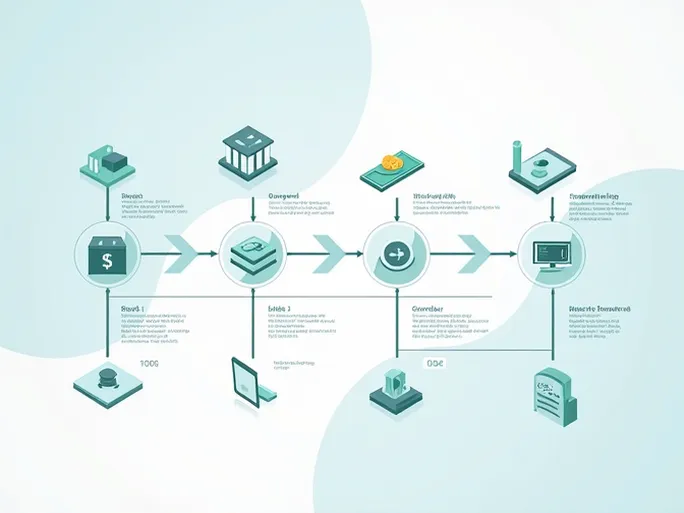

In today's rapidly globalizing and digitizing world, international money transfers have become an indispensable part of daily life and business operations. Whether it's parents supporting their studying children abroad, overseas workers sending remittances home, or businesses conducting cross-border transactions, accurate and secure international transfers are critically important. In this process, the correct use of SWIFT/BIC codes plays a vital role.

Understanding SWIFT/BIC Codes

The SWIFT/BIC code, also known as the Bank Identifier Code, is a standardized format developed by the Society for Worldwide Interbank Financial Telecommunication (SWIFT) to uniquely identify banks in international financial transactions. Typically consisting of 8 to 11 characters, the code's first four letters represent the bank, followed by country, location, and branch identifiers.

Using the correct SWIFT/BIC code is crucial for international transfers. An incorrect code may result in delayed transfers, misdirected funds, or even lost payments. As an example, SCOTIABANK CHILE's SWIFT/BIC code is BKSACLRM055, which can be broken down as follows:

- Bank Code (BKSA): Identifies SCOTIABANK

- Country Code (CL): Indicates Chile as the bank's location

- Location Code (RM): Specifies the bank's geographic location

- Branch Code (055): Identifies a specific branch (XXX typically denotes the head office)

Complete Transfer Information for SCOTIABANK CHILE

When transferring funds to SCOTIABANK CHILE, the complete SWIFT/BIC code BKSACLRM055 should be used along with the bank's address:

- Address: MORANDE 226, FLOOR 4

- City: SANTIAGO

Before initiating any transfer, verify these key details:

- Confirm the exact bank name matches the recipient's bank

- Verify the specific branch if a branch-specific SWIFT code is used

- Ensure the country in the SWIFT code matches the destination country

Advantages of Modern Transfer Services

International money transfer services offer distinct advantages over traditional banking channels:

- Competitive Exchange Rates: Typically offer better rates than banks by minimizing the margin between interbank and customer rates

- Transparent Pricing: All fees are clearly disclosed before transaction confirmation

- Faster Processing: Many transfers are completed within the same business day

Global Support for International Transfers

Reputable transfer services provide comprehensive customer support, available year-round to assist with SWIFT code verification and other transfer-related inquiries. These services also offer multi-currency account management capabilities, streamlining the transfer process while reducing costs.

For both personal remittances and business payments, specialized transfer services provide reliable and efficient solutions that combine financial security with operational convenience.

Conclusion

Correct SWIFT/BIC code usage remains fundamental to successful international money transfers. Services like those discussed above enhance the transfer process through favorable exchange rates, transparent fees, and reliable support systems. In an increasingly interconnected global economy, efficient and secure money transfer solutions have become essential financial tools for individuals and businesses alike.