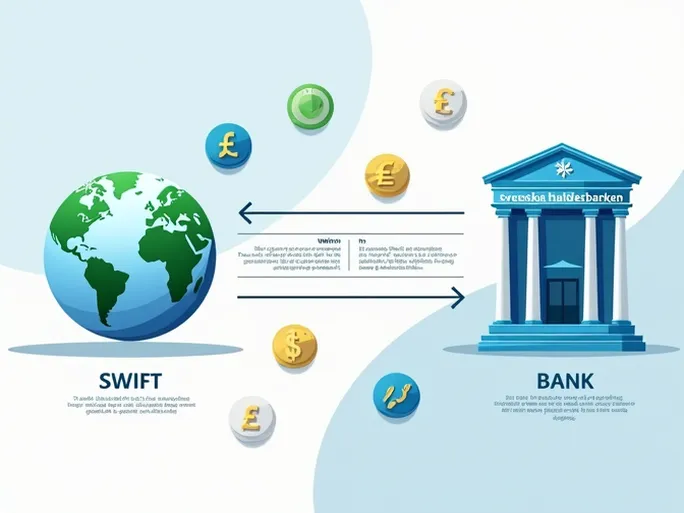

When making international wire transfers, navigating the complexities of cross-border banking can be daunting. One critical element ensuring the smooth flow of funds is the correct use of SWIFT/BIC codes. This article provides a detailed overview of the SWIFT code for Svenska Handelsbanken AB in Sweden, explaining its structure and significance for secure and efficient global transactions.

Svenska Handelsbanken AB’s SWIFT Code

The SWIFT code for Svenska Handelsbanken AB is HANDSESSGBG . Headquartered in Gothenburg, Sweden, the bank’s full address is Ostara Hamngatan 23, Goteborg, Vastra Gotaland, 404 26. SWIFT (Society for Worldwide Interbank Financial Telecommunication) codes serve as unique identifiers, ensuring funds reach their intended destination accurately and without delay.

Why SWIFT Codes Matter

Using the correct SWIFT code minimizes errors during international transfers, guaranteeing that funds are routed to the right bank and branch. Whether sending or receiving money, verifying the recipient bank’s SWIFT code is essential to avoid processing delays or misdirected payments.

Decoding the SWIFT/BIC Structure

Svenska Handelsbanken AB’s SWIFT code, HANDSESSGBG , follows a standardized format:

- First 6 characters (HANDSESS) : Identify the bank.

- Next 2 characters (GB) : Represent Sweden’s country code.

- Final 2 characters (G) : Specify the bank’s branch for precise routing.

Key Details for International Transfers

To ensure successful transactions, include the following details in your wire instructions:

- SWIFT code : HANDSESSGBG

- Bank name : Svenska Handelsbanken AB

- Bank address : Ostara Hamngatan 23, Goteborg

- City : Goteborg

- Country : Sweden

Security Considerations

Accuracy is paramount when handling international transfers. Always obtain SWIFT codes from official bank sources to prevent fraud or errors. Regularly verifying these details with the financial institution can safeguard against potential losses.

By understanding and correctly applying SWIFT/BIC codes, individuals and businesses can facilitate seamless cross-border payments. Staying informed through official bank updates ensures every transaction remains secure and efficient.