When transferring funds across borders, selecting a reliable and efficient bank is crucial. CRDB Bank, one of Tanzania’s largest commercial banks, has emerged as a preferred choice for many due to its exceptional services and streamlined international transfer channels. This guide explores how to leverage CRDB Bank for secure and swift cross-border transactions.

About CRDB Bank

Established in 1996, CRDB Bank is a leading Tanzanian financial institution offering comprehensive services, including corporate banking, personal banking, investments, and international financial solutions. With an extensive branch network across urban and rural areas, the bank ensures accessibility for all clients.

International transfers are often necessary for purposes such as tuition payments, receiving financial support from relatives, or conducting business transactions. CRDB Bank facilitates these transfers with multi-currency options, enhancing flexibility for cross-border financial flows.

The Role of SWIFT Codes

SWIFT (Society for Worldwide Interbank Financial Telecommunication) codes are essential for successful international transfers. These 8- to 11-character alphanumeric identifiers specify the recipient bank and branch, ensuring accuracy in transactions.

Incorrect SWIFT codes may cause delays or failures. CRDB Bank’s primary SWIFT codes include:

- CORUTZT10TD (for specific branches)

- CORUTZTZXXX (for the head office)

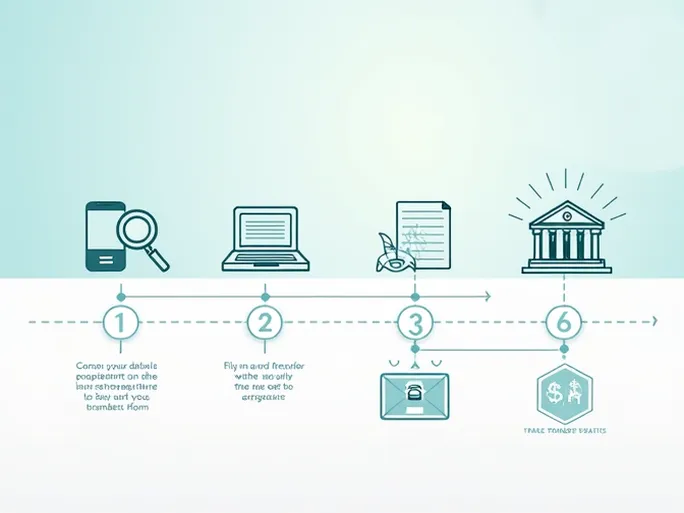

Steps for International Transfers

Follow these steps to execute a seamless transfer:

- Verify recipient details : Ensure the beneficiary’s name, account number, and SWIFT code are accurate. Contact CRDB Bank’s customer service or visit a branch if unsure.

- Select a transfer method : Choose between in-branch or online banking transfers, with the latter offering greater convenience.

- Complete the application : For in-branch transfers, fill out a remittance form with precise recipient and bank details.

- Pay applicable fees : Fees vary by transfer amount and destination. Confirm costs beforehand to avoid surprises.

- Track the transaction : Monitor the transfer status via online banking or by contacting the bank. Processing typically takes 2–5 business days.

Key Considerations

- Accuracy is critical : Double-check all recipient and SWIFT code details to prevent errors.

- Understand costs : Exchange rates and fees impact the final amount received. Clarify these with the bank before initiating transfers.

- Maintain communication : Coordinate with the recipient to confirm receipt. Follow up with the bank if delays occur.

- Prioritize security : Use secure networks for online transfers and avoid public Wi-Fi.

Additional Services

Beyond international transfers, CRDB Bank offers:

- Personal banking : Savings, loans, and digital banking solutions.

- Corporate banking : Financing, credit, and cash management services.

- Investment solutions : Wealth management and advisory services.

As Tanzania’s financial landscape evolves, CRDB Bank remains committed to delivering efficient, secure, and user-friendly cross-border payment solutions for individuals and businesses alike.