In international money transfers, the accurate use of SWIFT codes is crucial for ensuring smooth transactions. Whether you're an individual or a business owner, understanding how to use SWIFT codes, their structure, and their significance represents fundamental knowledge for all participants in international financial transactions. This knowledge not only protects your funds but also enhances transaction efficiency while minimizing potential complications. Today, we'll examine the importance of SWIFT codes and how EXIMBANK (Tanzania) Limited's SWIFT code facilitates secure international transfers.

What Is a SWIFT Code?

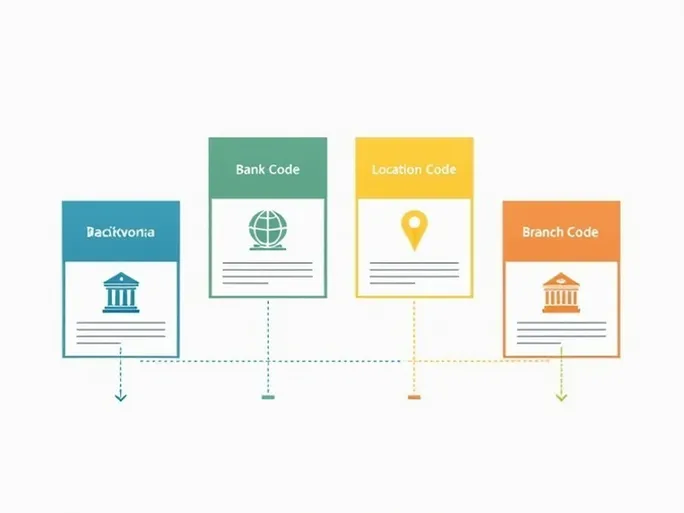

A SWIFT code, also known as a Bank Identifier Code (BIC), serves to identify financial institutions during international fund transfers. These codes are assigned by the Society for Worldwide Interbank Financial Telecommunication (SWIFT) to standardize international money movements and ensure accuracy and security. Typically consisting of 8 to 11 characters, each SWIFT code contains information including bank code, country code, location code, and branch code. But how exactly do these codes function?

The Structure of SWIFT Codes

SWIFT codes generally comprise four distinct components:

- Bank code (4 letters) : The initial four letters represent the specific bank's name. For EXIMBANK (Tanzania) Limited, this appears as "EXTN."

- Country code (2 letters) : Following the bank code, two letters indicate the country where the bank is located. Tanzania's country code is "TZ."

- Location code (2 letters/numbers) : This segment identifies the bank's precise location, using either letters or numbers. In our example, the location code also appears as "TZ."

- Branch code (3 letters/numbers) : The final component specifies particular branches when applicable. For EXIMBANK (Tanzania) Limited, the branch code is "TFD."

EXIMBANK (Tanzania) Limited's SWIFT Code

Based on this structure, EXIMBANK (Tanzania) Limited's complete SWIFT code is "EXTNTZTZTFD," which breaks down as:

- EXTN : Identifies EXIMBANK (Tanzania) Limited

- TZ : Represents Tanzania

- TZ : Specifies the location

- TFD : Denotes the particular branch

Understanding these character combinations proves valuable not only for executing international transfers but also for acquiring fundamental financial literacy. When encountering any SWIFT code, you can practice decoding its components to reveal the embedded information.

The Critical Role of SWIFT Codes in International Finance

SWIFT/BIC codes play a pivotal role in global financial transactions. Using incorrect codes may result in delayed payments, failed transfers, or even lost funds. In today's interconnected economy where cross-border commerce flourishes, the speed and precision of fund transfers have become increasingly vital. Errors can lead to complex consequences including transaction failures, project delays, and potentially missed business opportunities.

Ensuring SWIFT Code Accuracy

When initiating international transfers, verifying SWIFT code accuracy is paramount. First, request the recipient to provide their bank's current SWIFT code. Additionally, consult the bank's official website, where such information is typically published. For further confirmation, contact the bank's customer service to validate the code's authenticity.

The Importance of Selecting Appropriate Banks and SWIFT Codes

Choosing suitable banks and corresponding SWIFT codes effectively paves the way for successful international transactions. Unfamiliarity with a bank's reputation and service standards may compromise both fund security and transaction efficiency. Bank selection impacts not only fees and exchange rates but also the fundamental safety of transferred funds.

Key Considerations for International Transfers

When preparing international transfers, several additional factors warrant attention:

- Recipient details : Verify the recipient's name, account number, and other relevant information to prevent errors.

- Transfer amount : Cross-border transactions may involve amount restrictions, so confirm applicable regulations beforehand.

- Fees : Banks charge varying fees for international transfers—understanding these costs enables informed decisions.

- Exchange rates : Fluctuating rates affect final amounts, so monitor relevant exchange rates when transferring.

- Processing time : International transfers require processing periods—account for this when timing is critical.

Conclusion

By understanding EXIMBANK (Tanzania) Limited's SWIFT code, users can execute safer international transfers while gaining insight into global financial mechanisms. Though small in size, SWIFT codes represent indispensable components of international finance. Proper usage ensures funds traverse borders securely and efficiently. With this knowledge, individuals and businesses can approach international money transfers with greater confidence and competence.