In today's globalized financial environment, international money transfers have become an indispensable part of daily life for both individuals and businesses. As cross-border trade and personal financial transactions continue to grow, understanding how to conduct international transfers efficiently and securely has never been more important. Among the various components of international money transfers, the SWIFT/BIC code plays a critical role.

Understanding SWIFT/BIC Codes

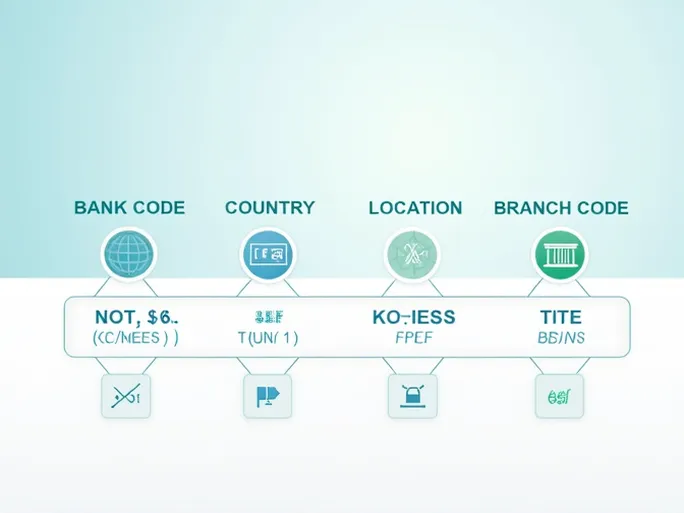

SWIFT (Society for Worldwide Interbank Financial Telecommunication) is a messaging standard used by banks and financial institutions worldwide, while BIC (Bank Identifier Code) is essentially a variant of SWIFT code. These terms are often used interchangeably. A SWIFT/BIC code consists of 8 to 11 alphanumeric characters that uniquely identify financial institutions globally.

Let's examine the SWIFT/BIC code for EXIMBANK (Tanzania) LTD: EXTNTZTZXXX to understand how these codes are structured.

The first four characters "EXTN" represent the bank code, identifying the specific financial institution. In this case, "EXTN" designates EXIMBANK (Tanzania) LTD. This portion is crucial as any error here could result in funds being sent to the wrong bank entirely.

The following two characters "TZ" constitute the country code, indicating Tanzania as the bank's location. Understanding the financial environment, regulations, and monetary policies of the recipient's country is equally important for successful international transactions.

The subsequent "TZ" represents the location code, specifying the bank's precise geographic area within the country. In this example, the repetition suggests the bank's headquarters location.

The final three characters "XXX" form the branch code. While this typically identifies specific branches, "XXX" indicates the primary office or headquarters. In some cases, more specific branch codes facilitate complex transactions, but our example directs funds to the main EXIMBANK (Tanzania) LTD office.

Ensuring Accurate Transfers

Correct SWIFT/BIC code usage is fundamental to successful international money transfers. Many assume simply copying the code suffices, but practical experience proves otherwise. Minor errors can cause significant delays or even lost funds. An incorrect bank code might route money to non-existent accounts or wrong institutions, potentially resulting in returns, delays, or worse.

To prevent such issues, senders should verify the SWIFT/BIC code with recipients before initiating transfers. Additional verification of the recipient bank's name, account number, beneficiary details, and bank address further reduces potential errors. For business users particularly, proper SWIFT/BIC code usage represents both operational best practice and financial protection.

International traders should also familiarize themselves with relevant regulations, including currency restrictions and foreign exchange policies that might affect transfers. Maintaining transparent communication throughout the process and consulting financial professionals when needed enhances transaction reliability. Preserving transfer documentation provides crucial evidence should disputes arise.

As global financial systems evolve, mastering international money transfer fundamentals grows increasingly valuable. Understanding SWIFT/BIC codes empowers individuals and businesses to navigate cross-border transactions confidently, minimizing risks while ensuring efficient, secure fund movement worldwide.