In today's globalized economy, international financial transactions have reached unprecedented levels of complexity. Within this cross-border financial network, ensuring accurate and secure international money transfers is critical—especially for individuals and businesses. Understanding how to correctly use SWIFT/BIC codes is essential for guaranteeing that funds reach their intended recipients without delays. This article explores the SWIFT/BIC code for EXIMBANK (TANZANIA) LTD and key considerations for international transfers.

1. Understanding SWIFT/BIC Codes

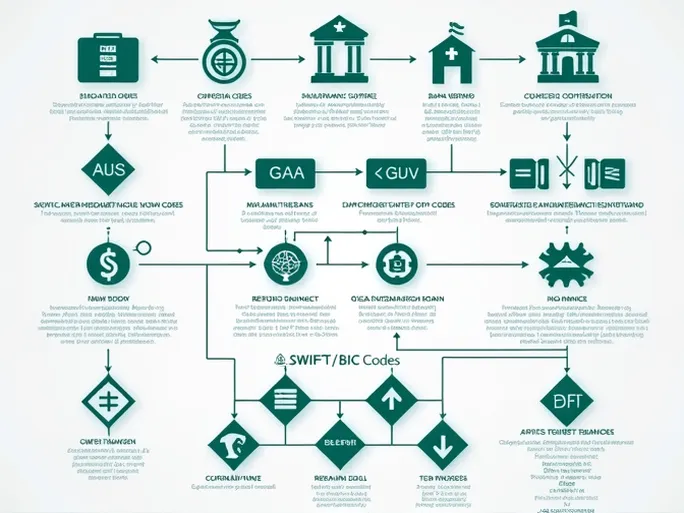

A SWIFT (Society for Worldwide Interbank Financial Telecommunication) code, also known as a BIC (Bank Identifier Code), is an 8- to 11-character alphanumeric sequence used to identify banks and financial institutions in international transactions. The structure of a SWIFT code is as follows:

- First 4 letters: Bank code (e.g., EXTN for EXIMBANK).

- Next 2 letters: Country code (e.g., TZ for Tanzania).

- Following 2 letters/numbers: Location code (city).

- Last 3 letters/numbers (optional): Branch identifier.

For EXIMBANK (TANZANIA) LTD, the SWIFT/BIC code is EXTNTZTZXXX , which identifies the bank’s specific location and branch. Familiarity with this structure helps prevent errors during transactions.

2. About EXIMBANK (TANZANIA) LTD

EXIMBANK (TANZANIA) LTD is a commercial bank registered and operating in Tanzania, offering a range of financial services, including deposits, loans, and international remittances. Headquartered at 9 Samora Avenue, Dar es Salaam, the bank is committed to providing efficient, secure, and convenient financial solutions in an increasingly interconnected global market.

Using the correct SWIFT code ensures timely transfers and facilitates seamless cross-border transactions for both personal and business purposes.

3. Steps for International Money Transfers

To execute an international transfer successfully, follow these steps:

- Select a transfer method: Options include banks, dedicated remittance services, or online platforms. Banks offer higher security but may charge more, while specialized services often provide faster and cheaper alternatives.

- Provide the SWIFT/BIC code: When filling out the transfer form, input the recipient bank’s SWIFT code (e.g., EXTN TZT ZXXX for EXIMBANK).

- Enter recipient details: Include the recipient’s full name, address, and account number accurately to avoid delays or failed transfers.

- Confirm the amount and currency: Verify the transfer amount and currency type, as exchange rates and fees may affect the final amount received.

- Check fees and exchange rates: Compare costs across providers to minimize expenses.

- Track the transfer: Use tracking tools provided by your bank or service to monitor the transaction’s progress.

4. Key Considerations

To ensure a smooth transfer process, keep the following in mind:

- Verify the SWIFT/BIC code: Double-check the code to prevent misdirected funds.

- Accuracy of recipient details: Even minor errors can cause significant delays.

- Fees and exchange rates: Understand all applicable charges to avoid unexpected costs.

- Transfer limits: Some countries or banks impose restrictions on transfer amounts or destinations.

- Security: Only use trusted and regulated providers to safeguard your funds.

5. Conclusion

Mastering the use of SWIFT/BIC codes, such as EXIMBANK (TANZANIA) LTD’s EXTN TZT ZXXX, is vital for efficient and secure international transactions. By adhering to proper procedures and precautions, individuals and businesses can ensure seamless cross-border fund transfers, fostering global financial connectivity.