In an era of increasingly globalized financial transactions, cross-border remittances have become an indispensable part of daily life. With the rise of international travel, business dealings, and personal financial management, the ability to transfer funds quickly and accurately across borders has emerged as a pressing concern for many. At the heart of this process lies the SWIFT/BIC code—a standardized identifier that ensures the security and efficiency of international bank transfers.

Among the myriad of SWIFT codes, NLCBTZTX0T8 stands out as a critical identifier for Tanzania's NATIONAL BANK OF COMMERCE. This code plays a vital role for individuals, businesses, and international clients seeking to transfer funds to the bank. This article provides a comprehensive analysis of the NLCBTZTX0T8 SWIFT code, exploring its structure, applications, and key considerations for users.

Understanding SWIFT/BIC Codes

The Society for Worldwide Interbank Financial Telecommunication (SWIFT) operates a global network that facilitates secure and precise international financial transactions. The SWIFT code—also known as the Bank Identifier Code (BIC)—is an alphanumeric sequence that uniquely identifies financial institutions worldwide.

A standard SWIFT/BIC code consists of 8 to 11 characters with the following structure:

- First 4 characters: Bank code (identifies the financial institution)

- Characters 5-6: Country code (indicates the bank's location)

- Characters 7-8: Location code (specifies the city or region)

- Characters 9-11 (optional): Branch identifier

This standardized system enables efficient communication and transaction processing between banks across different countries and time zones.

Decoding NLCBTZTX0T8: The NATIONAL BANK OF COMMERCE Identifier

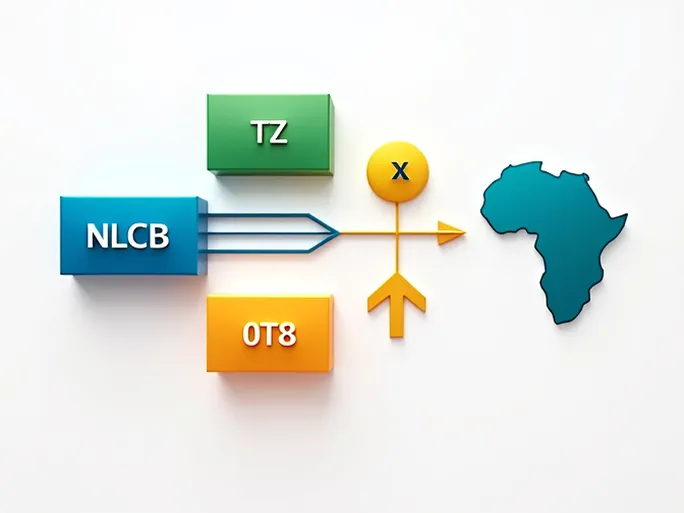

The SWIFT code NLCBTZTX0T8 serves as the unique identifier for NATIONAL BANK OF COMMERCE in Tanzania. A detailed breakdown reveals:

- NLCB: Bank code for NATIONAL BANK OF COMMERCE

- TZ: Country code for Tanzania

- TX: Location code for Dar Es Salaam

- 0T8: Potential branch identifier

This precise coding system ensures that international transfers reach the intended destination without unnecessary delays or complications.

Practical Applications of the NLCBTZTX0T8 Code

1. Personal International Transfers

Individuals sending money to accounts at NATIONAL BANK OF COMMERCE must include the NLCBTZTX0T8 code in their transfer instructions. Accurate entry of this identifier significantly increases the likelihood of successful and timely fund delivery.

2. Corporate International Trade

Businesses engaged in global commerce rely on SWIFT codes for international payments. When companies need to settle invoices with Tanzanian suppliers, providing the correct NLCBTZTX0T8 code ensures proper crediting to the recipient's account.

3. Foreign Exchange and Investment Transactions

Investors conducting cross-border financial operations require precise banking details. The NLCBTZTX0T8 code serves as an essential component for executing foreign exchange transactions or investment transfers to NATIONAL BANK OF COMMERCE.

4. Multinational Payroll Processing

Global enterprises with operations in Tanzania use the NLCBTZTX0T8 code to facilitate salary payments to employees banking with NATIONAL BANK OF COMMERCE. This ensures timely and accurate compensation delivery.

Critical Considerations When Using SWIFT Codes

While the NLCBTZTX0T8 code provides a reliable mechanism for international transfers, users should remain mindful of several important factors:

1. Verification of Banking Details

Always confirm the recipient's bank name, SWIFT code, and account number before initiating a transfer. Incorrect information may result in misdirected funds that can be difficult to recover.

2. Exchange Rates and Fees

International transfers typically involve currency conversion and various charges. Understanding these costs in advance enables better financial planning and prevents unexpected reductions in the transferred amount.

3. Processing Timelines

Transfer durations vary depending on the currencies involved and intermediary banks. Inquiring about expected processing times with NATIONAL BANK OF COMMERCE can help manage expectations regarding fund availability.

4. Transaction Monitoring

Most financial institutions offer tracking services for international transfers. Regularly checking the status of your transaction helps identify and resolve any potential issues promptly.

Conclusion

In today's interconnected financial landscape, the NLCBTZTX0T8 SWIFT code serves as more than just an identifier—it represents a crucial link in the global banking infrastructure. Whether for personal remittances, business transactions, or investment activities, proper use of this code ensures efficient and secure cross-border fund transfers.

As financial technology continues to evolve, new payment platforms may emerge, but SWIFT/BIC codes remain fundamental to international banking operations. By understanding and correctly applying these standardized identifiers, individuals and businesses can navigate the complexities of global finance with greater confidence and effectiveness.