In today's rapidly evolving financial landscape, cross-border transactions have become a routine necessity for individuals and businesses engaging in global commerce. Whether for personal remittances or corporate foreign exchange dealings, ensuring the precise and secure transfer of funds to the intended bank is paramount. Among the critical tools facilitating these transactions is the SWIFT/BIC code—an internationally recognized bank identifier. For DHAKA BANK PLC., the SWIFT/BIC code DHBLBDDH107 serves as a vital piece of information for any international transaction involving the institution.

An Overview of DHAKA BANK PLC.

Established in 1995, DHAKA BANK PLC. is a commercial bank headquartered in Bangladesh's capital, Dhaka. Located at Biman Office, Floor 1, 100, Motijheel C/A, Dhaka, Dhaka, 1000 , the bank has built a reputation for delivering diverse financial services tailored to both individual and corporate clients. Over the years, DHAKA BANK PLC. has actively contributed to Bangladesh's economic development by offering high-quality banking solutions.

As a modern financial institution, the bank operates across multiple sectors, including personal banking, commercial banking, and investment banking. Its international services are particularly noteworthy, catering to clients with global financial needs. Here, the SWIFT/BIC code plays an indispensable role.

Understanding SWIFT/BIC Codes and Their Significance

SWIFT (Society for Worldwide Interbank Financial Telecommunication) is a global messaging network that enables financial institutions to securely transmit information and instructions. The SWIFT/BIC code—an 8- to 11-character alphanumeric identifier—serves as a standardized format for recognizing banks and financial entities worldwide.

For DHAKA BANK PLC., the code DHBLBDDH107 ensures seamless electronic processing of international payments, remittances, and other financial transactions via the SWIFT network. One of its primary advantages is minimizing errors and delays, thereby enhancing transaction security and efficiency.

Using the correct SWIFT/BIC code is non-negotiable for international transfers. An incorrect code may result in funds being routed to the wrong account or experiencing processing delays, leading to financial losses or customer dissatisfaction. Verifying the accuracy of the SWIFT/BIC code before initiating any transaction is strongly advised.

Decoding the Structure of SWIFT/BIC Codes

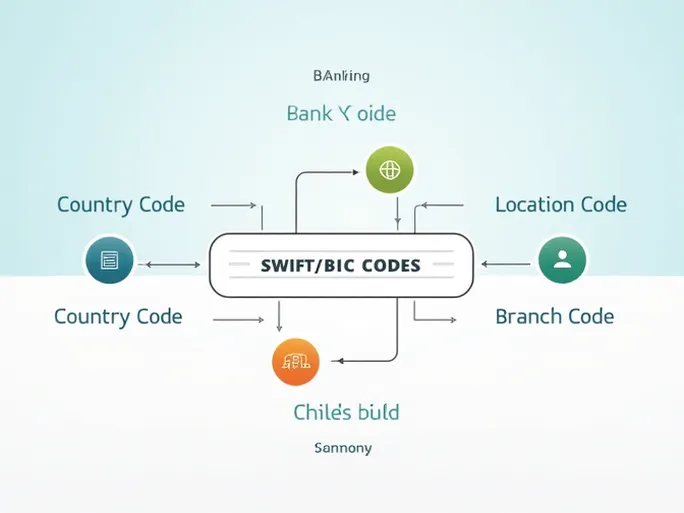

A SWIFT/BIC code comprises four distinct components:

- Bank Code (DHBL): The first four letters identify the specific bank—in this case, DHAKA BANK PLC.

- Country Code (BD): The next two letters denote the bank's country of origin, with BD representing Bangladesh.

- Location Code (DH): The subsequent two letters pinpoint the bank's headquarters location—here, DH stands for Dhaka.

- Branch Code (107): The final three digits specify a particular branch. If the branch code is "XXX," it typically indicates the bank's primary office.

Understanding this structure not only facilitates smoother fund transfers but also instills greater confidence in the transaction process.

Practical Applications in International Transfers

When initiating an international transfer to DHAKA BANK PLC., the sender must include the recipient's name, account number, and the SWIFT/BIC code DHBLBDDH107 . The SWIFT network uses this code to automatically identify and route the funds to the correct bank and branch, significantly expediting the process.

Enhancing Security in Cross-Border Transactions

Accuracy in SWIFT/BIC code usage is critical to preventing transfer failures, unnecessary fees, or delays. Given the complexity of international banking networks, even minor errors can result in misdirected funds or irretrievable losses.

To mitigate risks, customers should always confirm the recipient's SWIFT/BIC code and account details before proceeding with a transfer. A thorough grasp of SWIFT codes empowers clients to navigate international transactions with greater assurance.

Leveraging Technology for Efficient Transfers

Advancements in financial technology have streamlined cross-border payments. Many banks now offer digital platforms that integrate SWIFT services, enabling users to execute international transactions with ease. Mobile applications, for instance, often auto-fill SWIFT/BIC codes, reducing manual input errors and accelerating processing times.

Fees and Considerations in International Remittances

International transfers typically incur fees, which vary by institution. These may include fixed charges or percentages of the transferred amount. Additionally, exchange rate fluctuations can impact the final value of the funds received. Customers are advised to review fee structures and exchange rate policies beforehand to avoid unexpected costs.

The Global Reach of SWIFT

Since its inception in 1973, SWIFT has connected over 11,000 financial institutions worldwide, spanning banks, insurance companies, and investment firms. This extensive network ensures rapid and secure fund transfers, often completing transactions within hours—or even minutes.

Final Thoughts

In an interconnected global economy, SWIFT/BIC codes like DHBLBDDH107 for DHAKA BANK PLC. are indispensable for secure and efficient international transactions. Whether for personal or business purposes, mastering these identifiers minimizes risks and optimizes financial operations. As cross-border activities continue to expand, a solid understanding of SWIFT/BIC codes remains a cornerstone of successful international banking.