In today's interconnected global economy, cross-border money transfers have become a routine part of many people's lives. As work, study, and lifestyle patterns evolve, an increasing number of individuals need to move funds between countries—whether for personal use, supporting children studying abroad, or assisting relatives working overseas. While most users focus on transfer speed and fees, critical details like SWIFT/BIC codes often go overlooked. Understanding these codes provides an additional layer of security, ensuring your funds reach the intended bank without errors.

Understanding SWIFT/BIC Codes

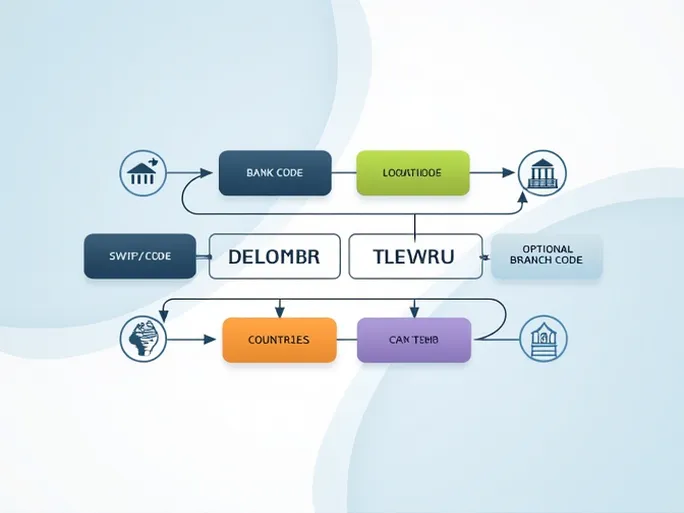

In modern international finance, SWIFT (Society for Worldwide Interbank Financial Telecommunication) serves as the backbone for global financial communications and transactions. The SWIFT/BIC (Bank Identifier Code) is a standardized unique identifier assigned to each financial institution within this network. These codes verify banking identities during transfers, guaranteeing accurate fund delivery.

A typical SWIFT/BIC code contains 8-11 characters: four letters identify the bank, two represent the country, two specify the location, and an optional three-character branch code. For example, S-BANK PLC's code—SBANFIHHXXX—breaks down as follows: "SBAN" identifies the bank, "FI" indicates Finland, "HH" denotes Helsinki, and "XXX" typically represents the head office when no specific branch is designated.

S-BANK PLC: A Case Study

Bank Name:

S-BANK PLC

SWIFT/BIC:

SBANFIHHXXX

Location:

Fleminginkatu 34, Helsinki, FI-00510, Finland

As a prominent Finnish financial institution, S-BANK PLC's SWIFT/BIC code plays a pivotal role in international transactions. This identifier precisely positions the bank within the global financial system, particularly for cross-border payments.

Why SWIFT/BIC Codes Matter

- Security: Each code's uniqueness prevents misdirected transfers. Errors may divert funds to wrong recipients or cause irreversible losses.

- Efficiency: The SWIFT network processes transactions rapidly. Incorrect codes delay settlements, sometimes for days.

- Compliance: Many jurisdictions regulate cross-border flows. Valid codes demonstrate adherence to financial regulations, minimizing legal risks.

Practical Applications

SWIFT/BIC codes facilitate various financial activities:

- Personal Remittances: Supporting family abroad or funding overseas education requires accurate beneficiary bank codes.

- Corporate Transactions: Global businesses rely on these identifiers for supplier payments, international payroll, and cross-border receivables.

- Foreign Investments: Individuals and institutions use them to transfer capital across markets securely.

Obtaining SWIFT/BIC Codes

Always verify codes before initiating transfers through these methods:

- Bank Contact: Customer service representatives provide official, up-to-date codes.

- Bank Websites: Most institutions list their codes under "Contact" or "International Banking" sections.

- SWIFT Directories: The organization maintains a searchable global database.

- Money Transfer Platforms: Some remittance services display required banking details during transaction setup.

Conclusion

SWIFT/BIC codes like S-BANK PLC's SBANFIHHXXX serve as financial GPS coordinates in global banking. These identifiers ensure precise routing, whether for personal needs or corporate requirements. By mastering their structure and application, users can navigate international finance with confidence, safeguarding their transactions in an increasingly borderless economic landscape.